Getting your Trinity Audio player ready...

While American cybersecurity company CrowdStrike's workers were sweating over the weekend not only to fix the unprecedented global computer shutdown it caused but also at attempts to draft letters to customers, employees and investors, something entirely different was happening in Israeli cybersecurity companies.

On the surface, most Israeli high-tech companies, big and small, took care to post diplomatic LinkedIn messages supporting their customers and offering specific solutions for rebooting their computers amid the impressive worldwide crash. Behind closed doors, however, quite a few champagne bottles were opened.

4 View gallery

Palo Alto Networks founder Nir Zuk and Wiz founder Assaf Rappaport

(Photo: Ryan Froese, Omer Hacohen)

CrowdStrike may not be a familiar name for many, but it’s a darling of the global cybersecurity market and the fiercest rival of almost every Israeli cybersecurity company.

CrowdStrike is synonymous with success in cybersecurity. It ended 2024 (a fiscal year that ended in January 2024) with revenues of $3 billion and cash flow of $1 billion, numbers reminiscent of Check Point, but it is growing faster and planned to end the current year with revenues of around $4 billion. Before the Israeli company Wiz emerged, CrowdStrike held most of the cybersecurity industry’s coveted titles.

For the Israeli cybersecurity industry, the company’s troubles are an opportunity. CrowdStrike is Israeli company Palo Alto Networks’s main competitor and resembles it both in size and in its aim of building a comprehensive platform that provides all the cybersecurity needs for organizations.

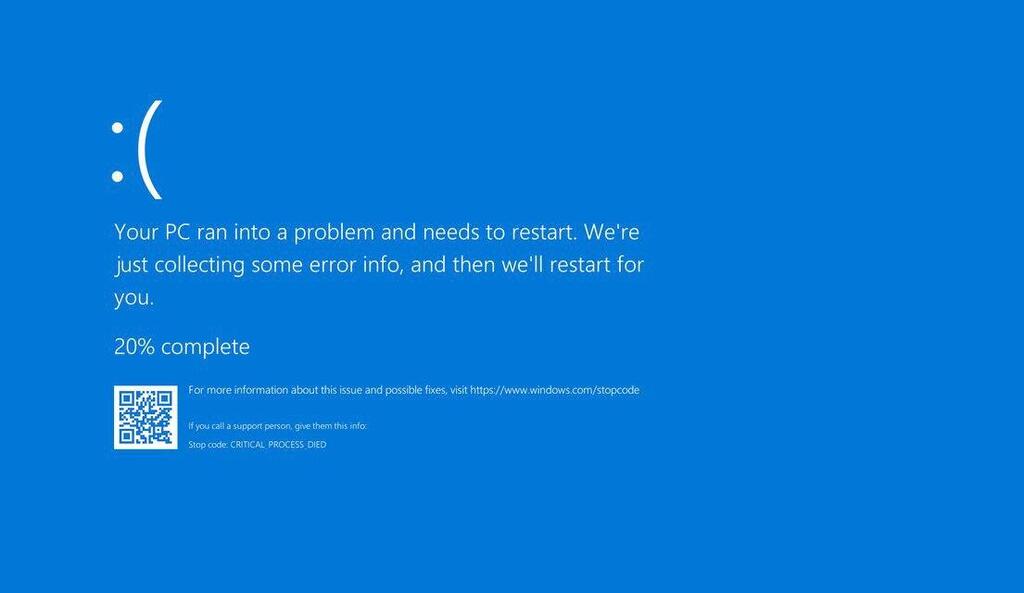

The specific problem that brought down the world's Windows-running computers over the weekend is related to the ENDPOINT product, meaning endpoint protection, which is the main competition against Palo Alto's Cortex products developed in Israel, and against SentinelOne's platform.

But for CrowdStrike, which started with endpoint protection most similar to old antivirus software, today has everything under its Falcon brand, now associated with the severe error it caused.

It also has cloud security solutions competing with Wiz, Orca, Palo Alto's Prisma, and Check Point's CloudGuard. The impact of the crisis in public companies like Palo Alto and SentinelOne could be seen in their stock prices rising versus the fall in CrowdStrike's stock, while the impact was less seen in private companies.

However, the emotional appeals published by startups such as Orca, DAZZ, and even Zafren are essentially a declaration: 'we’re here and ready to provide you with alternative solutions'.

CrowdStrike’s collapse comes at an interesting time for the cybersecurity market. It saw a consolidation frenzy for about a year since Palo Alto, which surpassed CrowdStrike in both valuation and revenue, began pushing it toward an all-inclusive platform vision.

The logic behind this is clear – cybersecurity managers in organizations are exhausted from having dozens of different software to manage, and it’s preferable to move to one comprehensive solution, which may not offer the highest quality in every security field but will be good enough for most.

Within this framework, CrowdStrike also became a significant acquirer, making two purchases of Israeli startups last year totaling $500 million. The current incident exposes the downside of enormous dependence on a single supplier that ships even just one mistake.

The drop in CrowdStrike's stock on Friday wasn’t only due to investor anger but also from expectations that potential customers will now turn to competing suppliers, where Israeli companies now enter the picture more strongly than ever.

The market may once again develop a preference for smaller startup companies, and therefore a niche of Israeli organizations. It was quite surprising to discover how many institutions in Israel were affected by CrowdStrike's malfunction, and this might be an opportunity to switch things up using Israeli products.

Beyond the business rivalry, CrowdStrike is part of an exit strategy for many Israeli cybersecurity startups. The American company, which has a $4 billion reserve and wants to expand its solution portfolio, has become a target for Israeli venture capital funds looking for a buyer for their offerings.

To signal to investors and customers it’s trying to improve its platform and also to convey "business as usual," approach, CrowdStrike may make further acquisitions in the near future, making Israel a tempting development hub.

We also can’t ignore the implications of the weekend’s events on the developing deal between Wiz and Google. Although the error didn’t occur due to an area where Wiz competes with CrowdStrike, the malfunction revealed Microsoft's enormous cybersecurity centralization and the world's dependence on it.

Even if Google's shareholders might have thought that $23 billion was too high a price to pay for the Israeli company at the beginning of the week, they now received a demonstration of Google's potential to bite into Microsoft's market, provided it has the better cybersecurity solution.