Security ship deal was changed to accommodate ThyssenKrupp

Def. Min. reportedly changed stated security requirements needed to protect natural gas reserves in Mediterranean, switching from smaller ships to larger ones, whose building was eventually granted to German company ThyssenKrupp, despite not meeting original requirements.

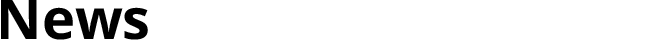

New information on ThyssenKrupp's bribery of senior officials reveals that the bid to purchase navy vessels from them was originally proposed to a South Korean Shipyard for the construction of four 1,200 ton security ships, but was signed two years later with ThyssenKrupp for the purchase of four 1,800 ton warships.

According to former Production and Procurement Directorate head Brigadier-General (res.) Shmuel Zucker, ThyssenKrupp wasn't even contending for the tender at first, since it didn't construct 1,200 Corvette-type warships that the Defense Ministry requested.

Zucker did not hide what he thought were dubious motives in the change in the deal.

"The ship offered by the Germans is not at all like what the navy asked for," he told Channel 10 television interviewer Raviv Drucker. "The changes smelled fishy."

Zucker also claimed that former of the Israeli National Security Council (NSC) senior member Brig.-Gen. (ret.) Avriel Bar-Yosef, who was arrested for alleged offenses of bribery, money laundering, fraud, and breach of trust in the submarine case, threatened that if he did not cancel the tender with the Koreans, the relationship between Merkel and the prime minister would be harmed and that Germany might even vote against the settlements.

In the end, the tender was signed with the Germans in January 2015, and the ships the navy is expected to receive, of the Sa'ar 6-class corvette model, weigh about 2,000 tons.

When South Korean representatives asked to clarify the matter, it was made clear to them that the decision on the purchase was transferred from the Ministry of Defense to the NSC.

It is important to note that these are not minor changes, but a dramatic conceptual change. Although he acknowledges that the German subsidy of about a third of the deal—which is valued at around 1.5 billion euro—may lower the cost from Israel's point of view, Zucker stresses that it is impossible to say that Israel accepted the best offer.