Police looking into 'Milchan law' giving tax exemptions to returning residents

Investigators ask Tax Authority for information on attempts to cancel law, which grants new immigrants and returning residents an exemption from taxes on their income abroad for 10 years; Netanyahu allegedly sought to extend the exemption period to 20 years, which would've benefited Milchan.

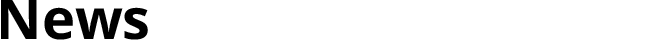

After submitting their recommendation to indict Prime Minister Benjamin Netanyahu for bribery, the police are now examining one of the prime minister's alleged attempts to help his billionaire friend Arnon Milchan.

Police have asked the Tax Authority for information on attempts to cancel the law, which gives tax exemptions to returning residents for 10 years.

Netanyahu allegedly sought to amend the law and extend the exemption period to 20 years, which would've greatly benefitted Milchan.

The Tax Authority has made no less than five attempts to cancel the law, which has been dubbed the "Milchan law," over the past six years, but these attempts have been thwarted by the government and Knesset every time.

Critics of the legislation, which exempts new immigrants and returning residents from paying taxes on their income abroad for a decade, say it discriminates in favor of returning residents—and mostly tycoons—and against Israeli citizens. Critics have warned the law could turn Israel into a "tax haven." Furthermore, critics argue that instead of Israel joining developed countries in the fight against money laundering, the law will have the opposite effect.

Among the law's critics was also the state comptroller, who harshly criticized it five years ago.

The law, which came into effect a decade ago, is estimated to have caused NIS 10 billion in losses to state coffers. However, there is no accurate data of these losses, precisely because the law exempts returning residents and new immigrants from reporting their income abroad to the Tax Authority.

"We can't know exactly what is the sum that hasn't been paid in taxes because of this exemption, and there are different estimates. In any case, we're talking about billions of shekels," a Tax Authority official said.

The law was passed in 2008, while Ehud Olmert was prime minister, and was meant to encourage immigration to Israel and the return of wealthy Israelis who left, as well as encouraging them to invest their money in Israel.

Police investigators suspect Netanyahu has shown an interest in the law and turned to then-finance minister Yair Lapid in 2014, asking him twice whether Milchan had spoken to him about it. Lapid told the police Netanyahu and Milchan approached him on the matter four times.

The prime minister allegedly told Lapid the law was "important for the state" and could help businessmen like Milchan, who had returned to Israel.

Tax Authority officials estimated that an extension of the exemption period from 10 years to 20 would have given Milchan tens of millions of shekels in tax benefits.

Lapid, however, did not amend the law.

Milchan was not the only one to enjoy the tax benefits afforded by the law. Even though there is no accurate data, Tax Authority officials believe other businessmen who immigrated to Israel also enjoyed the benefits of the law.