Some Iranians had been cashing in their savings even before US President Donald Trump’s announcement he would pull out from the international nuclear deal with Iran, straining a banking system weighed down by bad loans and years of isolation.

An official with Iran’s biggest state-owned Melli Bank told Reuters savings had declined by an unspecified amount, although he said this was a temporary phenomenon and that they would recover once the uncertainty over Trump’s decision passed.

“When there is political uncertainty, its psychological impact on people causes a drop in savings. But it will pass after Trump’s deadline,” the official said before the announcement, declining to be named.

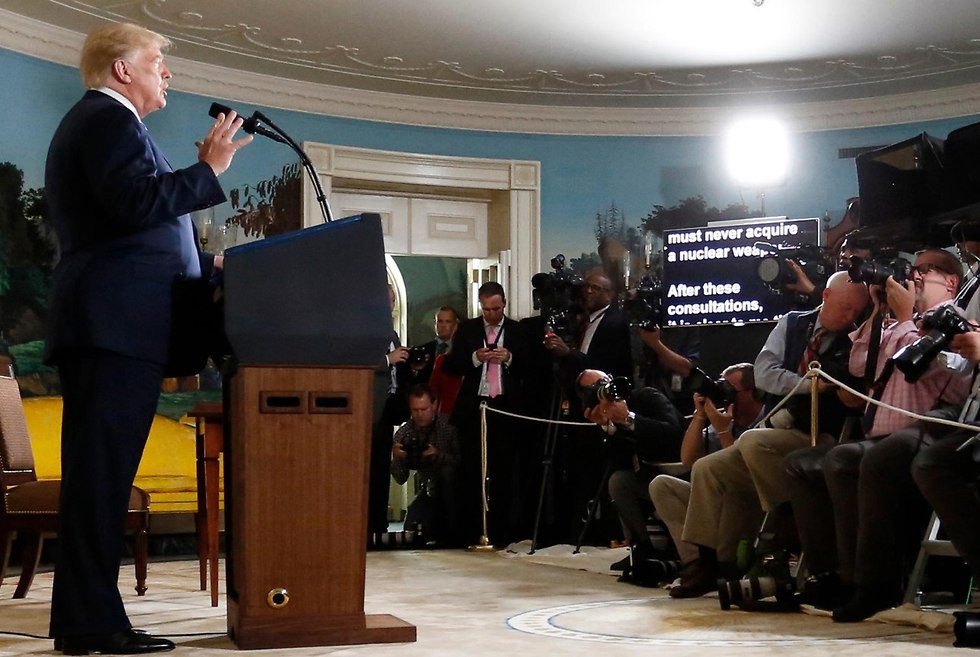

Trump said on Tuesday he would quit the deal and impose “the highest level of economic sanctions”.

A senior Iranian central bank official said conditions within the banking system had deteriorated in the past year, and “we have still not passed the danger zone” but added that the central bank had “all the measures ready to prevent any crisis”.

Officials with other leading lenders, Saman, Pasargad and Middle East Bank declined to comment.

The loss of confidence both reflects and contributes to wider problems threatening pragmatist President Hassan Rouhani in Iran’s faction-ridden clerical establishment: investment has dried up as banks limit lending, growth is slowing and unemployment is at a record high, exposing Rouhani to growing criticism from hardliners.

“I am worried about a war,” said Mina Abdelsalehi, 61, a retired teacher in Tehran. “I have changed all my savings into gold coins that I can cash easily if anything happens.”

The rial currency lost close to half of its value in the six months to April in anticipation of a tougher US approach, forcing Tehran to ban domestic foreign exchange transactions and limit foreign currency holdings to $12,000.

This failed to stop Iranians trying to buy hard currency on Tuesday, promoting a further slide in the rial, according to a foreign exchange website.

“Prices are going up almost every hour,” said Ali Rasti, 45, owner of a real estate agency in Tehran. “People are worried and prefer to keep their money at home.”

A separate Iranian banking official also said Iranians had taken out money. “Fearing a war and more sanctions, many Iranians have withdrawn their cash from banks,” he said.

Mohammad Reza Pourebrahimi, head of parliament’s economic committee, was quoted by the semi official ISNA news agency in March as saying capital outflows had been $30 billion in recent months. The International Monetary Fund said Iran’s reserves were at nearly $112 billion in 2017/18.

Dashed hopes

Iran had struggled to reap the benefits from the accord, which lifted international sanctions on the central bank and lenders in 2016 in return for curbs on its nuclear program, but left US restrictions in place to assuage fears it would benefit hardliners like the Revolutionary Guards (IRGC).

The IRGC, which reports directly to Iran’s Supreme leader Ayatollah Ali Khamenei, controls vast segments of the economy including some banking interests as well as everything from ports management to telecommunications.

Iranian banks re-established relationships with more than 200 international counterparts, but any business active in Iran has to ensure there are no ties with IRGC interests to avoid fines or bars on trading in the United States.

“Money is moving but not as freely as governments had hoped,” said Justine Walker, head of sanctions policy with trade association UK Finance, saying complications had multiplied since Trump became president. Euro transactions were taking place, she said, but sterling payments “remain challenging”.

Sources involved in transactions said they rarely exceeded 200 million euros ($240 million) due to difficulties with clearing payments.

Nigel Kushner, chief executive of British law firm W Legal, said his clients exporting consumer goods to Iran had reported a 50 percent drop in purchases over the past two months. “There is a risk of further (bank) liquidity concerns,” he said.

George Bennet, managing partner of financial services advisory firm OSACO Financial, which is active in Iran, said European lenders still in Iran were already nervous and limiting transactions to their largest and most valuable customers.

“The larger of the European banks currently doing business, which themselves are not large, with Iran will pull out of the market altogether,” he said, when asked about the impact of the US withdrawal.

Other constraints

Rouhani gambled on attracting foreign investment to help raise living standards but a raft of deals including plane purchases have been already been delayed.

FATF, a global group of government anti-money-laundering agencies, has kept Iran on its blacklist, adding to wariness by Western banks with dealing with Iran due to reputational risks.

Rouhani has struggled to reform the banking system, which, with 30 banks and other credit institutions, is more fragmented than those of other emerging markets and heavily burdened by bad loans.

Finance sources have estimated outstanding loans at around $283 billion and non-performing loans (NPLs) were estimated to have reached 12.5 percent in 2017 by US-based financial industry body the Institute of International Finance (IIF).

The latest official figure, 11.7 percent in 2016, equates to more than $30 billion. Some finance sources say NPLs could be even higher at close to 15 percent.

A textile factory owner in Mashhad said the government wanted to improve the economy but could not support business.

“How can I run my business when the dollar exchange rate is rising and I cannot get loans from the banks because of the high rates?” he said on condition of anonymity, explaining he had laid off around half his 65 employees to try to stay afloat.

“I am not sure how long I can keep the factory open.”

Iran rial plunges to new low

The Iranian rial plunged to a record low against the US dollar in the free market on Wednesday, fuelling fears of an economic crisis in Iran.

The dollar was being offered for as much as 75,000 rials, compared to around 65,000 just before Trump announced his decision on Tuesday night, according to foreign exchange website Bonbast.com, which tracks the free market.

Dealers in Tehran quoted similar levels on Wednesday, according to an Iranian economist outside the country who is in touch with them. One dealer said the rial had hit 78,000, while another said he had made two sales of dollars at 80,000.

The currency has been sliding for months because of a weak economy, financial difficulties at local banks and heavy demand for dollars among Iranians who feared a pullout by Washington from the nuclear deal, and renewed US sanctions against Tehran, could shrink the country's exports of oil and other goods.

The rial has tumbled from around 57,500 at the end of last month and 42,890 at the end of last year—a freefall that threatens to boost inflation, hurt living standards and reduce the ability of Iranians to travel abroad.

In an effort to halt the slide, Iranian authorities announced last month they were unifying official and free-market exchange rates at a single level of 42,000, and banning any trade at other rates under the threat of arrest.

But this step failed to stamp out the free market because authorities have been supplying much less hard currency through official channels than consumers are demanding. Free market trade simply went underground, dealers said.

Tehran residents told Reuters on Wednesday that activity in the free market had decreased considerably, because people feared getting arrested and the wild volatility of exchange rates increased the risk for dealers.

Nevertheless, the dealer who reported dollar sales at 80,000 said one of his sales was to a person who had sold his apartment a week ago. This person had now decided to buy dollars instead of another apartment in Iran, he said.

Buyers seek US waivers to buy Iranian oil amid new sanctions

South Korea, meanwhile, said on Wednesday it would seek US exemptions to buy Iranian oil, a path many big oil consumers are likely to follow in the wake of new US sanctions on Tehran, which will tighten world oil markets and push up prices.

Iran is the third-largest oil producer in the Organization of the Petroleum Exporting Countries (OPEC) and a key supplier, especially to refiners in Asia.

New US sanctions will include measures aimed at its oil and shipping sectors, with a six-month "wind down" period "to allow companies to end contracts, terminate business, (and) get their money out", according to the US State Department.

"President Trump is clearly articulating that he has minimal desire in an alternative agreement with Iran," said Ehsan Khoman, head of research for Middle East and North Africa at Mitsubishi UFJ Financial Group.

During the last round of sanctions, Iran's oil supplies fell by around 1 million barrels per day (bpd), but the country re-emerged as a major oil exporter after sanctions were lifted in January 2016.

Since then, Iran ramped up supplies, producing 3.81 million bpd in March 2018, almost 4 percent of global output. Its crude exports averaged over 2 million bpd in January-March quarter this year.

Analysts now expect Iran's supplies to fall by between 200,000 bpd and 1 million bpd, depending on how many other countries fall in line with Washington.