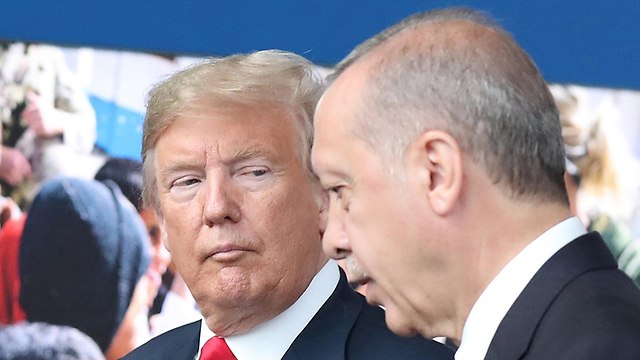

Trump and Erdogan

Photo: EPA

Turkish lira pulls back from record low, action plan awaited

Following a meltdown of Turkish lira last Friday, President Erdogan's son-in-law and Turkey Finance Minister Berat Albayrak announces new economic plan to be implemented soon in order to counteract President Trump's sanctions, as lira begins to recover.

The Turkish lira traded stronger than 6.80 to the dollar, pulling back from a record low of 7.24 overnight, after Finance Minister Berat Albayrak said Turkey would start implementing an economic action plan on Monday morning.

The lira has lost 44 percent against the dollar this year, largely over worries about President Tayyip Erdogan's influence over the economy, his repeated calls for lower interest rates and worsening ties with the United States.

The lira's relentless fall turned to meltdown on Friday. It dropped as much as 18 percent at one stage, rattling US and European stocks as investors took fright over banks' exposure to Turkey.

On Monday the renewed lira collapse hit Asian shares, weakened the South African rand and drove demand in global markets for safe currencies including the US dollar, Swiss franc and yen.

Finance Minister Albayrak said in an interview published late on Sunday that Turkey has drafted a economic action plan and will start implementing it to ease investor concerns.

"From Monday morning onwards our institutions will take the necessary steps and will share the announcements with the market," he said, without giving details.

BlueBay Asset Management strategist Timothy Ash said the plan should have been ready before Asian markets opened.

"They are just always behind the curve, always catching up, always too late, and then the damage is done. Text book stuff of how not to manage a crisis," he wrote on Twitter.

Albayrak said budget discipline would be the most important foundation of Turkey's new economic approach and fiscal rules would be implemented for targeted indicators if necessary.

The minister also said a plan has been prepared for banks and the "real" economy, including small to mid-sized businesses which are most affected by the foreign exchange fluctuations.

"We will be taking the necessary steps with our banks and banking watchdog in a speedy manner," he said.

Albayrak dismissed any suggestion that Turkey might intervene in dollar-denominated bank accounts, saying any seizure or conversion of those deposits into lira was out of the question.

In the interview with Hurriyet newspaper, Albayrak described the lira's weakness as "an attack," echoing Erdogan—who is his father-in-law.

Erdogan, who has called himself an "enemy of interest rates," wants cheap credit from banks to fuel growth, but investors fear the economy is overheating and could be set for a hard landing.

On Sunday, speaking to supporters in Trabzon on the Black Sea coast, Erdogan dismissed suggestions that Turkey was in a financial crisis like those seen in Asia two decades ago.

The lira's free-fall was the result of a plot and did not reflect economic fundamentals, he said. "What is the reason for all this storm in a tea cup? There is no economic reason ... This is called carrying out an operation against Turkey," he said.

The central bank raised interest rates to support the lira in an emergency move in May, and again the following month. But it did not tighten monetary policy at its last meeting three weeks ago.

The lira hit a record low of 7.24 against the dollar during in Asia Pacific trade. It pared losses after Albayrak's comments and was trading at 6.73 to the dollar at 0433 GMT.

Turkey's banking watchdog BBDK in a statement said it was limiting banks' foreign exchange swap transactions.