Illustration

Photo: Shutterstock

Israel's Finance Ministry is working on a plan to allow some first-time home buyers raise mortgages worth up to 90 percent of the value of the house they are purchasing, helping them cope with surging property prices.

A report in Yedioth Ahronoth, Ynet's print sister publication, said the ministry would allow young couples borrow 90 percent up to a maximum property value of 1.3 million shekels ($363,301).

The Bank of Israel, or central bank, set a cap of 75 percent earlier this decade to slow price rises, but property values have continued to rise.

The ministry told Reuters it was working on raising the limit to 90 percent but did not give further details.

Near zero interest rates have made housing a top investment in Israel. Israel's home prices have more than doubled in the past decade to an average of about 1.5 million shekels.

Apartments in Tel Aviv cost more than 2 million shekels on average and those in Jerusalem cost 1.9 million shekels.

Yedioth Ahronoth said the government would have to provide funding or guarantees for a loan above 75 percent.

A central bank spokesman said the government had not approached the bank with a plan to raise the mortgage cap and declined to comment further.

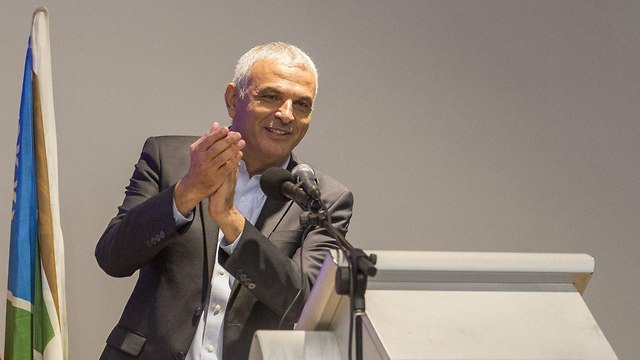

Finance Minister Moshe Kahlon, who campaigned in the 2015 election on reducing house prices, has sought make it simpler to obtain permits to build new homes, offered developers discounts on buying land and provided subsidies for some new building projects.

The central bank said in a March report the subsidies had created a two-tier system, with some benefitting from assistance and others struggling to afford homes at free market prices.

The next election is due in 2019.

Housing starts fell in 2017 to 49,660 from 55,622 while starts were 11,228 in the second quarter of 2018, compared with 12,798 a year earlier.