Getting your Trinity Audio player ready...

Five years after the World Health Organization first described the COVID-19 coronavirus outbreak as a pandemic, its effects are still being felt on the global economy.

COVID-19 and efforts to contain it triggered record government debt, hit labor markets and shifted consumer behavior. Inequality has increased while remote work, digital payments and changes in travel patterns have endured.

5 View gallery

People queue for COVID-19 tests in front of a laboratory in Paris amid the spread of the coronavirus disease (COVID-19) pandemic in France

(Photo: Reuters)

Though the immediate shock has passed, COVID-19's legacy continues to reshape global economies and markets. Here are some of the main impacts.

Debt, inflation and interest rates

After countries borrowed money to protect welfare and livelihoods, global government debt has risen by 12 percentage points since 2020, with steeper increases seen in emerging markets. The pandemic sparked high levels of inflation, which proved to be a major concern in the 2024 U.S. elections. Fueled by post-lockdown spending, government stimulus packages and shortages of labor and raw materials, inflation peaked in many countries in 2022.

To offset rising prices, central banks raised interest rates, though the intensity of their interventions varied widely.

Sovereign credit ratings, which reflect a country's ability to pay back its debts, were driven lower as economies were shuttered and governments took on huge amounts of extra debt to fill the holes left in public finances.

Data from Fitch Ratings shows the average global sovereign credit score remains a quarter of a notch lower than it was when the pandemic started, reflecting financial challenges made worse by the pandemic, inflation and stricter financial conditions.

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

For less wealthy emerging market countries, the average remains roughly half a notch lower.

Lower credit ratings generally translate into higher borrowing costs on international capital markets.

Labor and travel shifts

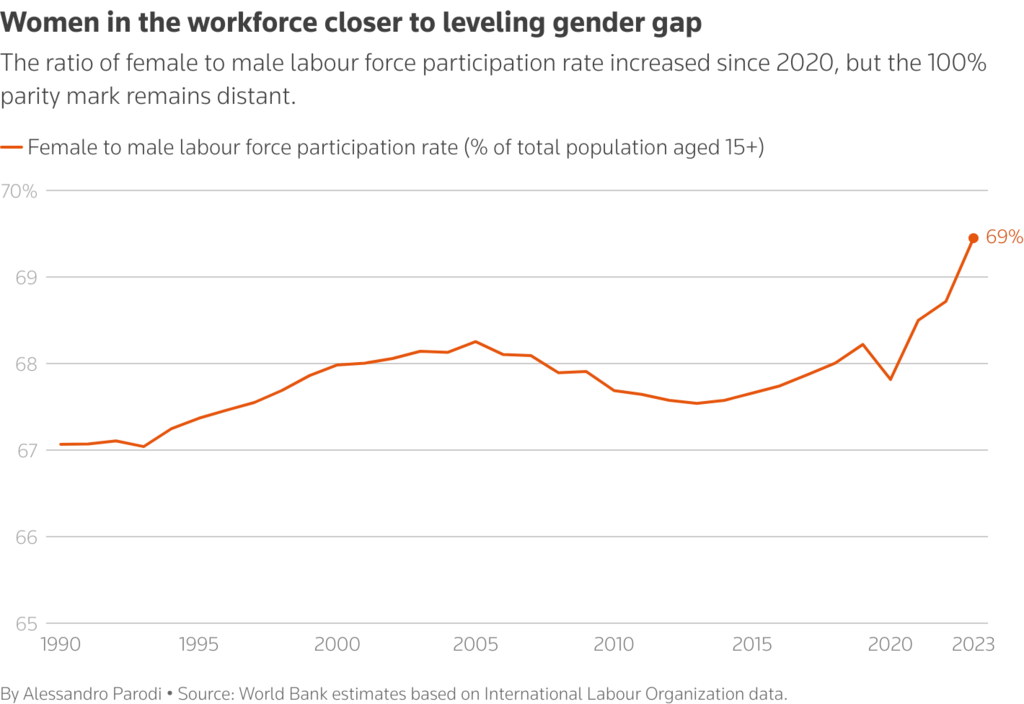

The pandemic caused millions of job losses, with poorer households and women hit hardest, according to the World Bank.

As lockdowns eased, employment regained momentum but with a considerable shift toward sectors such as hospitality and logistics due to the growing retail delivery sector.

Women's participation in the workforce fell in 2020, mostly due to female overrepresentation in hard-hit sectors like accommodation, food services and manufacturing, and the burden of caring for children staying home from school. However, the gender employment gap has slightly decreased since, data shows.

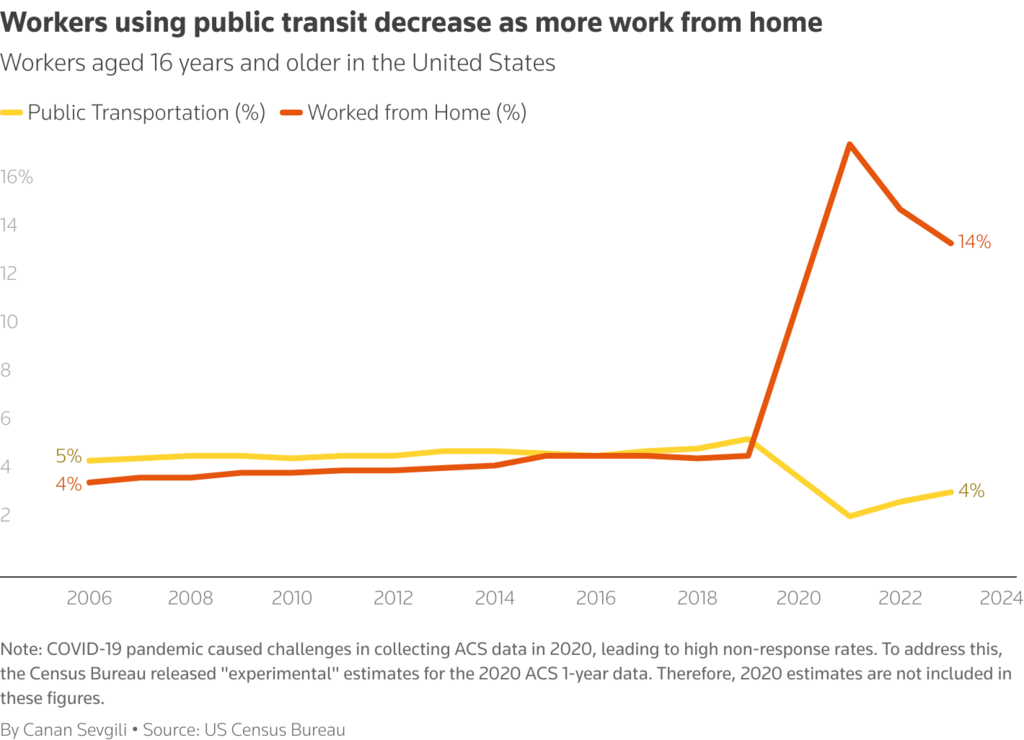

Travel and leisure habits also changed. While people travel and eat out as much as they did in 2019, an increase in work-from-home has reduced commuting in major cities such as London.

In London, use of both the Tube and buses remains at around a million fewer journeys a day than before the pandemic.

The airline sector was among the hardest hit, recording industry-wide losses of $175 billion in 2020, according to the global airlines body IATA.

Vaccination campaigns eventually resulted in the lifting of travel restrictions, allowing people back on planes. For 2025, IATA expects an industry-wide net profit of $36.6 billion and a record 5.2 billion passengers.

But travelers must contend with hotel room prices, which in many regions have outpaced inflation and remain well above 2019 levels.

In the first half of 2023, Oceania, the continent in the Southern Hemisphere that includes Australia and smaller nations like Tonga and Fiji, saw the highest price increases from the same period in 2019, followed by North America, Latin America and Europe, according to data from Lighthouse Platform.

Despite minor fluctuations, there is little indication that global hotel prices will return to pre-pandemic norms.

Office vacancy rates are also at record highs in many countries, the result of more remote and flexible work. In the U.S., central business districts had the largest rise in vacancies, which are still evident today.

Ushering in a digital world

New consumer trends developed during global lockdowns as homebound consumers often had no other option than to shop online. This caused an uptick in online purchases from 2020 that has since stabilized. Analysts say that in Europe, the rise in online sales has been coupled with an increase in selling space as retailers invest in physical shops to stimulate both online and offline sales.

The space, measured in square meters, edged up almost 1% from 2022 to 2023, an increase that should extend to 2.7% by 2028, data from market research company Euromonitor shows.

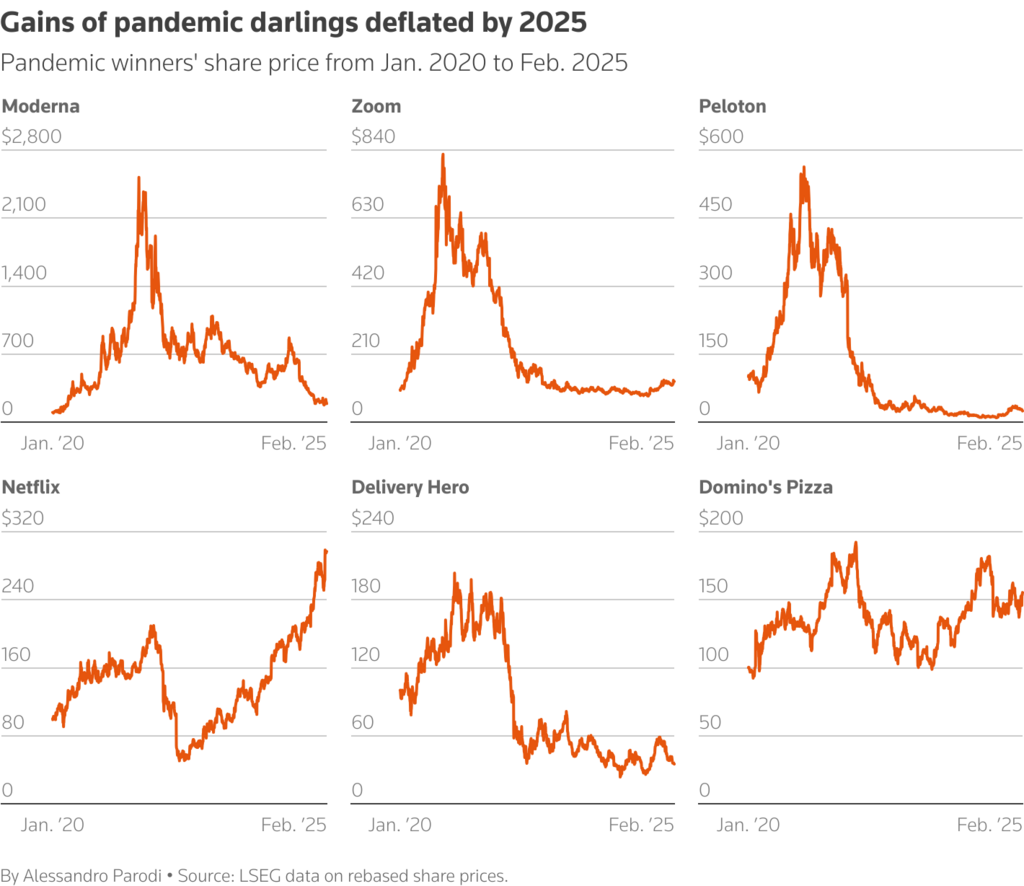

Shares in digital and delivery firms led gains during the pandemic, alongside those of vaccine-making pharmaceutical companies.

Five years on, some pandemic-era gainers have lost most of their appeal, but others have enjoyed lasting gains as new markets enabled by the digital shift have opened up.

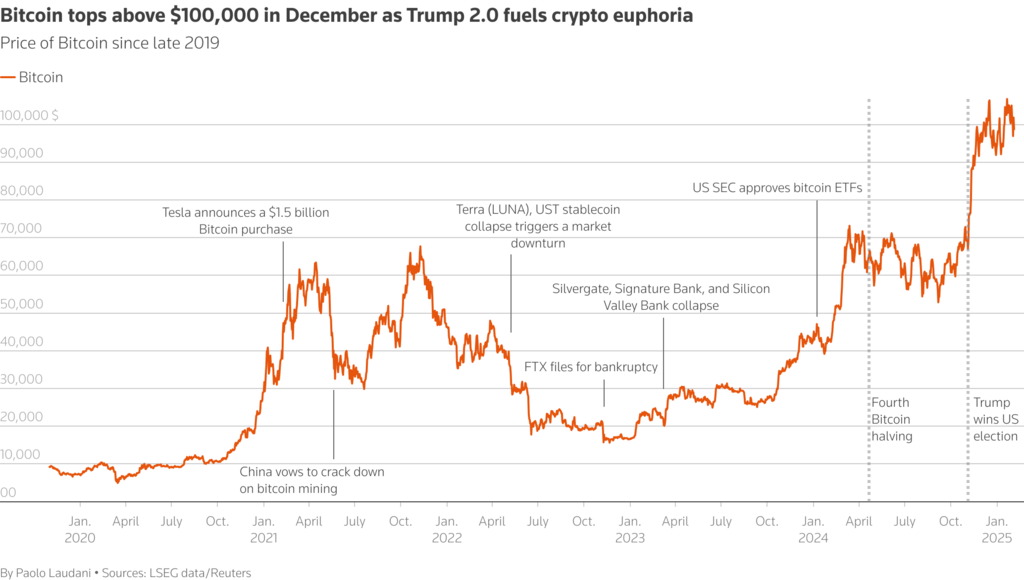

Despite the bursting of some bubbles and the collapse of crypto exchange FTX, which left the industry reeling, the value of Bitcoin has increased by 1,233% since December 2019 as people looked at new investment opportunities to cut the risk of market volatility.

Stuck at home and with more cash on hand, people also began investing more, with roughly 27% of total U.S. equity trading coming from retail investors in December 2020.

Stockbroker TD Ameritrade took the biggest slice of the cake before being acquired by Charles Schwab in a $26 billion deal. Another platform that gained popularity during the retail trading boom of 2021 is Robinhood, which became the platform of choice for people to pump money into meme stocks.