Getting your Trinity Audio player ready...

Last month, China's state-owned steel giant, Baowu, the world’s largest steel producer, warned that Chinese manufacturers are facing a "steel winter" set to last longer than the previous market crises in 2008 and 2015. The grim outlook is driven by the ongoing crisis in China’s real estate sector, which has sharply reduced demand for raw materials.

The timing couldn't be worse, with China’s economy growing by just 4.7% in the second quarter of 2024, missing growth forecasts of 5.1%.

The Chinese steel industry, largely controlled by state-owned companies, is still recovering from the previous two crises of the 21st century. Baowu itself emerged from a 2016 merger of two state-owned companies that was prompted by the 2015 steel market crash, quickly becoming the world’s second-largest steelmaker and claiming the top spot by 2022.

As of June 2024, China accounted for 43% of global steel production, with India a distant second at 8%. U.S. production, ranked fourth, was just 8% of China's output.

In 2023, China was responsible for 46% of global steel production, while Baowu alone accounted for 7%.

China’s real estate market saw significant contractions of 21% and 39% in 2022 and 2023, respectively. Housing starts, which are steel-intensive, dropped by 24% in the first half of 2024, delivering a severe blow to the domestic steel market. Typically, 55% of China’s steel production goes to the local construction sector.

As domestic demand plummeted, Chinese steel producers faced a dilemma: maintain production levels or slow down in response to weaker demand. However, amid an overall economic slowdown, neither factories nor the Chinese government wants to further decelerate.

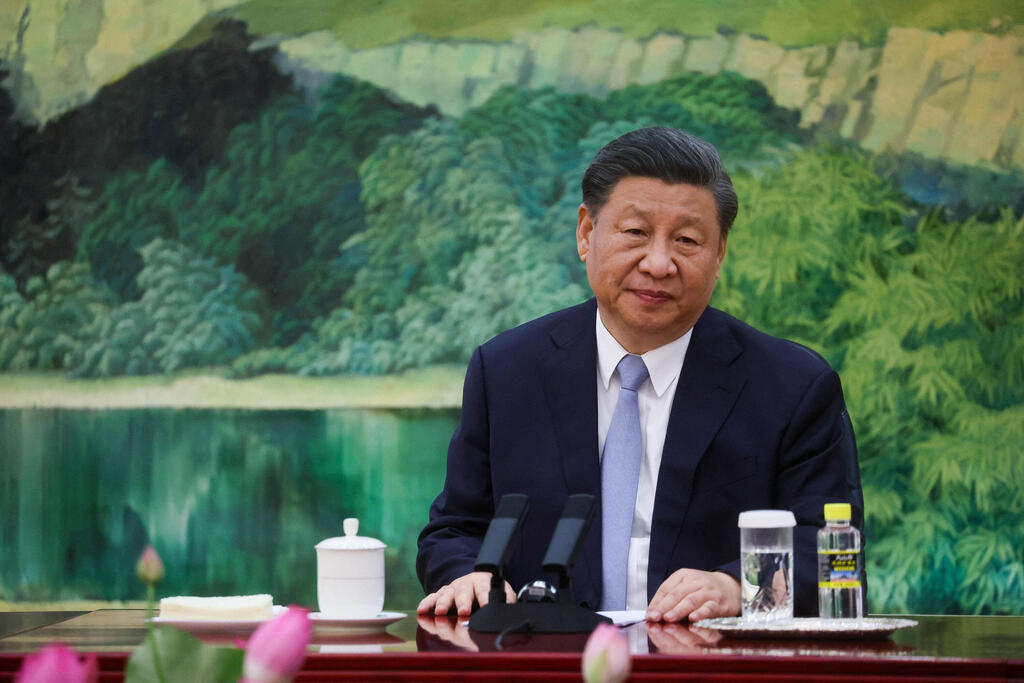

President Xi Jinping, addressing China’s economic outlook for 2024, emphasized the need to "promote stability through growth" and prioritize new industries like electric vehicles and solar panels before addressing overcapacity in traditional sectors like steel. Until then, China is expected to ramp up steel exports to stabilize its economy, with its largest export markets in 2023 being South Korea, Vietnam and the European Union.

Iron ore prices take a dive

In line with China's strategy, domestic steel production dropped by just 2.2% in the first half of the year, with a significant 9% decline reported in June compared to the same month in 2023.

The focus shifted to exports, with Chinese manufacturers boosting steel exports by 17% year-on-year, reaching 53 million tons—an eight-year high. To avoid production cuts that could damage future output and market share, Chinese producers sold at a loss, leading to a sharp drop in raw material prices for the construction industry.

The price of iron ore, a key raw material for steel production, has fallen by over 33% since the start of the year, trading at a nearly two-year low. In July 2021, as the global economy began recovering from the COVID-19 pandemic, iron ore hit an all-time high of $220 per ton.

The flood of cheap Chinese steel on global markets has prompted governments to take protective measures. Earlier this month, the European Commission announced an investigation into Chinese companies, accusing them of dumping steel at below-market prices. It also introduced limits on the import of certain steel products.

Several other countries, including Vietnam, the United States, Saudi Arabia, Brazil and Chile, have launched similar investigations. Thailand and India have imposed tariffs on Chinese steel for several years. India, despite being the world's second-largest steel producer, became a net importer of steel in 2024. Brazil's steel manufacturers have called for tariffs ranging from 9.6% to 25% on imported steel products.

Mexico has imposed an 80% tariff on Chinese steel imports, in coordination with the United States, which fears China may attempt to route cheap steel through the southern border.

In April, President Joe Biden announced a tariff increase on Chinese steel products from an average of 7.5% to 22.5%, with similar tariffs applied to metals produced in Mexico using Chinese steel.

"Chinese steel and aluminum entering the U.S. market via Mexico are undermining our investments and harming American workers in states like Pennsylvania and Ohio," said Lael Brainard, director of the White House National Economic Council. In response, the Chinese embassy in the U.S. dismissed the claims of overproduction as "baseless" and accused the U.S. of using them as a "political tool to smear and suppress China’s economy."

'The current market situation is unsustainable'

The world's second-largest steel producer, ArcelorMittal, reported that China's excess steel production has made global market conditions unsustainable. "Steel prices in Europe and the U.S. are below marginal cost," said an ArcelorMittal spokesperson, adding, "The current market situation is unsustainable."

Last week, German steelmaker Salzgitter reported losses for the first half of the year, partially attributing them to overproduction and Chinese exports. Meanwhile, Chile's largest steel company, CAP, recently announced the closure of its Huachipato steel plant due to its inability to compete with low-cost Chinese steel.

As global markets face increasing pressure from China’s steel exports and nations ramp up protective measures, China is being forced to reassess its strategies. Last weekend, Beijing unexpectedly announced a halt to the approval process for new steel plants, signaling recognition of growing trade tensions. This system, in place for years, had encouraged growth and more efficient steel production.

Government fed real estate bubble, until it popped

The catalyst of the steel crisis is China’s real estate market crash, which itself was fueled by years of government policy. After promoting rapid real estate growth—responsible for about 29% of China’s GDP—the government abruptly halted low-interest loans to developers in 2020, triggering bankruptcies, including that of Evergrande, the world’s most indebted property developer, with liabilities estimated at $300 billion.

Around 10 million homes in China were estimated to have been sold by developers but never completed, leaving buyers without their paid-for properties. Research firm Rhodium reports that local real estate loans total around $10 trillion. Alongside the unbuilt homes, 4 million completed but unsold homes remain vacant, as potential buyers are wary amid a financing crunch and a trust crisis following developers’ collapses.

In May, China introduced a plan to address the housing crisis, repurposing vacant homes. The government allocated $42 billion to state-owned real estate companies to purchase these properties and offer them for affordable rent, with the proceeds used to complete unfinished projects.

Eligibility for loans is limited to projects included in a "white list" of 8,200 developments identified by local authorities and approved by the Ministry of Housing and Urban-Rural Development (MOHURD) and the National Financial Regulatory Administration (NFRA). These agencies coordinate loan approvals, prioritizing projects where homebuyers have already paid but construction remains incomplete.

This is the latest in a series of measures aimed at addressing the crisis. Chinese news outlet Caixin has tracked over 300 initiatives designed to restore public trust in the real estate market and help local governments recover from the halt in land sales, a key revenue source.

The crisis has had wide-reaching effects, including a sharp drop in demand for building materials and labor, leading to plummeting steel prices. Additionally, local authorities reliant on land sale taxes have tightened budgets, and homeowners left without their promised properties have also curbed their spending.