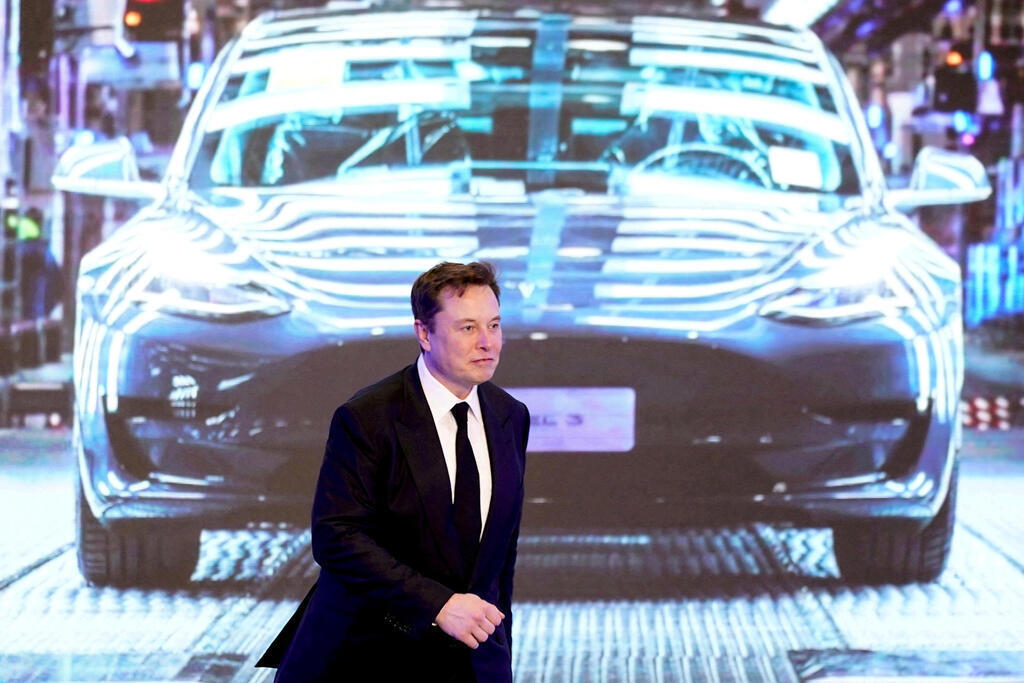

Tesla, a young American manufacturer with a limited and outdated range of electric models, is led by a capricious owner whose statements often spark controversy and bewilderment. Despite making promises that are rarely fulfilled, Tesla has managed to establish itself as a major player.

Read more:

On the other hand, we have the old and esteemed German luxury and sports car brands, known for their rich history and esteemed reputation. Additionally, there is an international car conglomerate boasting the largest variety of brands and models in the industry's history. Surprisingly, the value of these two sides is more or less the same.

It's important to recognize the immense profitability of the car industry. With the combined value of car manufacturers' shares exceeding $2.7 trillion, it's evident that this industry generates massive amounts of revenue. Although the industry experienced a slight setback due to the COVID-19 pandemic and ongoing supply chain issues, experts predict that it will reach a staggering $3.6 trillion by 2031.

Leading the pack is Tesla, which has maintained its dominant position for years and has only widened the gap. As of Thursday, January 18, Tesla's market value stands at an astonishing $685 billion. It's worth noting that even though its value has depreciated by 25% in recent weeks, since 12.27, Tesla remains a force to be reckoned with.

In a staggering display of dominance, Elon Musk's electric car maker now surpasses the combined market value of the world's seven largest car manufacturers. This stark contrast becomes even more evident when we consider the aggregate calculation of the largest manufacturers in terms of sales, where Tesla outshines the likes of General Motors and Ford, whose stock market value fails to make a lasting impression.

Chinese making strides

Taking second place is Toyota, the renowned and largest car manufacturer globally, with a respectable value of $261 billion. Beyond that, the rest of the contenders pale in comparison.

Surprisingly, the Chinese company BYD takes third place in market value, surpassing the rest of the industry, with a staggering $75 billion. This Chinese electric car manufacturer has made significant strides in capturing the global (and Israeli) market by rapidly expanding its range of models and production capabilities, including hybrid vehicles. Unlike Tesla, BYD's founder, Wang Chuanfu, recognized that the world is not yet fully prepared for the electric revolution and continues to offer alternative propulsion options alongside electric vehicles.

To gain a deeper understanding of the situation, let's take a brief glance at global electric car sales figures, which shed further light on the story and may foreshadow the unwritten future. In terms of annual electric car sales, Tesla secured the top position in 2023, selling an impressive 1.81 million electric vehicles, marking a remarkable 38% increase.

However, BYD is swiftly progressing and made a historic achievement in the final quarter of 2023 by outselling Tesla for the first time since 2014 when another manufacturer surpassed the pioneer of the electric revolution. BYD concluded the year with a remarkable surge of 73%, selling 1.59 million electric vehicles. With its high sales momentum and Tesla's ongoing challenges in delivering its delayed compact car, it is highly likely that BYD will surpass Tesla in deliveries in 2024, making BYD's stock performance a topic of great interest.

Interestingly, profitability among manufacturers reveals a completely different landscape. For instance, Toyota outsells Tesla by a factor of five. As a result, Toyota claims the top spot in profitability, generating a staggering $38 billion, while Tesla settles for nearly $12 billion. In second place is the German manufacturer BMW with $29 billion, followed by industry giants Volkswagen and Mercedes, with $24.5 billion and $23 billion respectively. Even Hyundai, ranking 15th among manufacturers, surpasses Tesla with $13.3 billion in profitability.

Our two cents: Despite the unpredictable nature of its CEO, Elon Musk, it appears that Tesla will maintain its position at the top in the coming years. However, the real story lies with BYD and other Chinese brands, which pose a significant challenge to their Japanese, European, and American counterparts.

Gone are the days when Chinese brands were simply perceived as "basic and simplistic products" (at least those exported to the West). Today, they offer highly advanced and often high-quality products that continue to gain momentum in sales. This success is often reflected in their stock values as well.