Despite the challenges the Israeli economy is facing - the surging deficit, rating downgrades and accelerated inflation rate - local investors maintained cautious optimism: the Tel Aviv Stock Exchange 35 Index rose by 14% since October 7, bank stocks and real estate stocks in particular, showed a positive year-end, and the biggest rally was registered among defense stocks.

An appropriate image that one can attach to the Tel Aviv Stock Exchange in the last seven trading days of September is of an "ostrich burying its head in the sand." After months of being attacked, the IDF quite suddenly escalated its military offensive in Lebanon which culminated in the assassination of Hezbollah leader Hasan Nasrallah, thus dramatically increasing the risk of war on multiple fronts.

At the same time, the stock market reacted positively for seven consecutive days, which led to a series of articles in the local media, attempting to explain the puzzling behavior of investors in the local market.

The seemingly unexpected sequence is merely a reflection of the trends that characterized the Tel Aviv Stock Exchange in the twelve months that have passed since the October 7 massacre. After the sharp declines as an initial reaction, there was a recovery, which later turned to stocks rising – albeit not an unrestrained rally, as the war was still ongoing, but a cautious optimism was shown. This despite the negative effects the geopolitical situation had on the economy.

Since the October 7 atrocities, the biggest in its history, the State of Israel has been at war in the south, which has also developed into the north and intensified in recent weeks, including a direct confrontation with Iran.

The local economy is paying a heavy price: the deficit in the last year jumped to 8.3%, compared to 1.3% in the year before the war, and the international rating companies downgraded Israel's ratings (Fitch downgraded one time, S&P downgraded twice and also Moody's downgraded twice, the last of which was double) with a negative forecast.

Furthermore, capital fundraising by Israeli tech firms has declined in recent months - the industry that constitutes Israel's engine of export and growth, although it is less significant in the local stock exchange, the retail, finance and real estate sectors.

Yet, investors did not panic. In the year that has passed since the outbreak of the war, the Tel Aviv 35 index rose by 14.1%, TA 125 recorded an increase of 12.2% during this period, and TA 90 index recorded an increase of 8.5%.

The relative optimism of investors can be attributed to the social, economic and cultural life that has returned to normal in large parts of the country. As the current economic activity has not been extremely affected - as evidenced, for example, by the credit card transaction and retail revenues data, which have returned to pre-war level - there is no real reason to panic. The consistent decrease in the inflation level, albeit not at the expected pace, and the recovery in the real estate industry, contributed to the relative optimism.

Thus, except for the first quarter that followed October 7, numerous companies on the Tel Aviv Stock Exchange returned to perform similarly or even better than pre-war levels. The fluctuation of the Tel Aviv 35 Index, TASE's flagship index, was less sharp and was composed of companies in dominant sectors of real estate, finance and technology.

The Israeli market was affected by global markets, and above all the U.S. market, which rose sharply in the past 12 months. In other words, when the stock exchange in New York surges, the stock market in Tel Aviv may not rise as much, but it will have trouble lagging behind, as the U.S. economy and its corporations strongly affect local Israeli companies - directly and indirectly.

Concluding the last 12 months, the S&P 500 rose by 34%, the Dow Jones by 28% and the Nasdaq by 36%. The stock market in Tel Aviv registered a moderate increase, and involved short pricing, in view of the war - but it definitely drew strength from the American indices.

The Tel Aviv Banks Index, which includes the five largest banks in the country, registered in the last 12 months an increase similar to that of the leading indices, of 9.3%. In the real estate industry, Tel Aviv Real Estate index registered an increase of 14.2%, TA construction rose 14.7%, TA-investment properties in Israel rose 12.3% and TA-investment properties abroad rose 17.2%.

The sectoral indices were led by TA retail, which jumped by 26.3% in the last 12 months, mainly thanks to a 93% jump in Shufersal shares, after an ownership change this year.

Activity in the bond market

Particularly high turnovers were recorded during the year in the bond market, which to a large extent provided a more decisive response to the economic situation following the war, compared to the stock exchange market.

The Finance Ministry was required to increase its bond issuances by tens of percent, to cover in part the huge increase in government spending. As a result, the daily trading volume in government bonds averaged almost NIS 3.5 billion since the outbreak of the war - a jump of more than 30% compared to the 12 months preceding October 7, 2023.

The activity clearly showed a sharp decline in the value of government bonds, especially in the long series, and correspondingly a sharp increase in yields. This is an expression of Israel's high level of risk, and as a consequence of the zero chance of an interest rate cut in the coming months. Israel's monetary policy along with the persistent inflation rate resulted in keeping interest rates unchanged which are likely not to be cut further.

Israel's 10-year bond yield on October 5, 2023, the last trading day before the October 7 massacre, was 4.26%. Today it is 4.99% - a jump of 73 basis points during the period.

The trend in the U.S. was completely the opposite due to the sharper decline in the inflation rate and the growing expectations for the Fed's first interest rate cut (which was indeed carried out at the last meeting of the U.S. Bank). The U.S. 10-year bond yield on Friday, October 6, 2023, was 4.80%, compared to 3.97% today - a drop of 83 basis points.

The forex market just seems to be getting excited

The shekel-U.S. dollar exchange rate is very sensitive to war developments and security events. The effect of Iran's ballistic missile attack on Israel earlier this month, for example, was evident on the foreign exchange market, with a further weakening of the shekel against the dollar.

The value of the American currency did not register a significant change compared to the Israeli currency in the past year. In the first weeks of the war, the shekel depreciated significantly and was above NIS 4/$, but the sharp depreciation did not last long.

The dollar is currently trading at around NIS 3.72/$ - similar to its level at the beginning of October 2023. This is despite the war and significant economic events that occurred this year - including interest rate cuts by central banks around the world, like the Federal Reserve and the Bank of Israel.

What happened to the 'war' stocks?

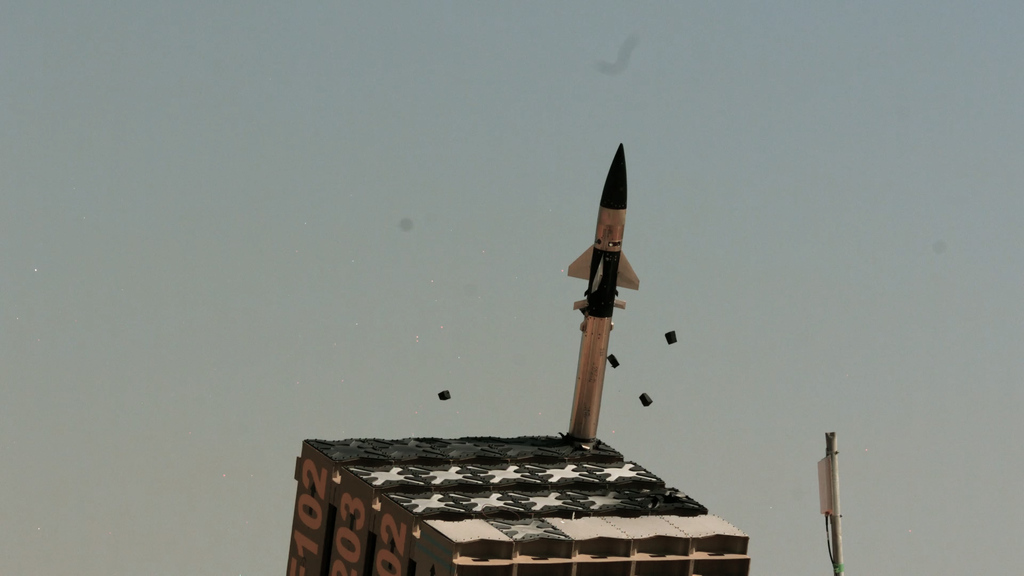

The largest Israeli defense company is Elbit Systems, the manufacturer of weapons, defense systems and military equipment controlled by the Federman family.

Elbit Systems has a market cap of NIS 34 billion ($9.14 billion), which makes Elbit the largest defense company on the Tel Aviv Stock Exchange and the sixth most valuable company; it is also traded on Wall Street. But during the war year, the stock fell in Tel Aviv by 2.8% (from October 7 till today), despite its record results.

In the second quarter (April, May and June), the defense company's revenues grew by 12%, and the backlog of orders reached a record of $21 billion.

Elbit Systems CEO Bezhalel Machlis' explanation for the stock’s performance is that Elbit is an Israeli company which large part of its revenues goes to the IDF and the Defense Ministry, leading to counter reactions from pro-Palestinian and anti-Israel bodies around the world, such as the BDS, which also take part in violent protests against the company, especially in the UK.

"It affects us not only in England. The Bank of Nova Scotia in Canada, which was a large investor in Elbit, sold a substantial stake in Elbit and pushed the share price down", said Machlis after presenting the second quarter financial results.

The second largest defense company on the stock exchange is NextVision Stabilized Systems, which manufactures stabilized cameras for ground and aerial vehicles that are in great demand by Elbit and the Israeli Aerospace Industry (IAI). The company is trading at a market cap of NIS 3.1 billion (over $1 billion). Its share price has jumped 70% since October 7 and has risen by 300% in May since the beginning of the war. However, the company recorded a decrease in the order backlog in the second quarter and after it published its financial reports the stock began to weaken.

Razor Labs is a software company that develops artificial intelligence solutions and products. It engages also in ammunition control, through its product "Inspection AI" which can automatically detect a wide range of ammunition defects during the production process, and it was approved by a global defense customer.

This field during both the war in Israel and the difficult geopolitical reality, requires the company to improve its product and to recruit new customers. Razor Labs has a market cap of NIS 167 million and itsstock rose by 697% in the year of the war.

Aerodrome Group Ltd is an aerial intelligence company that utilizes and analyzes data acquired by the use of drones and UAVs. It has a market cap of NIS 31 million and decreased by 10%. In May, its share price reached NIS 134, but has gradually decreased since then, with the cancellation of a deal to sell drones to a foreign customer in the background. Today it is trading at a price of NIS 34.

Third Eye Systems, which operates in the field of drones (provides the vEYE system for the identification and detection of explosive drones and UAVs) trades at a value of NIS 119 million and is up 126%. Its main customers are Elbit Systems, IAI and Rafael.

Bet Shemesh Engines, whose controlling owner is Ishay Davidi's FIMI Opportunity Funds, which manufactures and renovates aircraft engine parts (mainly for jets), is traded at a value of NIS 2.3 billion. The stock was up 168% in the year of the war.

The electronics manufacturer Orbit Technologies Ltd, which has a market cap of NIS 590 million, jumped by 19%. Orbit is a provider of airborne communications, satellite-tracking, maritime, ground-station and new space solutions for commercial and government establishments.

Other defense companies that stood out in the war are IMCO Industries Ltd, which trades at a value of NIS 148 million and jumped by 174%, RSL Electronics, which trades at a value of NIS 69 million, increased by 26%. The two companies engage in manufacturing electronic products for military use.

Imagesat International, a satellite services company, has a market cap of NIS 830 million, jumped by 30%. Aryt Industries a manufacturer of electronic fuses for the military market which trades at a value of NIS 463 million, was up 141%.

Outside the defense arena, El Al shares were among the biggest beneficiaries of the security situation. Many international airlines canceled routes to Israel amid security concerns, which made the Israeli El Al at certain times the only option for passengers, and the rest of the time the preferred option for those who wanted to be sure that their flight would not be canceled. El Al chose to raise the prices of flight tickets, and thus its market share jumped by 92.6%.

Israir's share price, on the other hand, has fallen 11.9% due to the weakening of its subsidiaries' activities, primarily Diesenhaus, which engages in incoming tourism.

The hotel stocks, which were hit by the weakening of incoming tourism and housed displaced residents for extended periods of time, resulted in lower yields than expected, ended the first twelve months of the war with rises - Dan Hotels added 1.9% to its value, Fatal strengthened by 9.6%.

The increase in the TA-35 Index is not solely due to the security situation

The Israeli stocks on the local flagship index, TA-35, rose significantly since October 7 regardless of the war.

The leading stock on the stock exchange amidst the war months is Shufersal, Israel's largest supermarket chain, which jumped by 92.8% in the last twelve months, during which, as mentioned, its owners changed as well as a significant part of its managing directors.

Toward the end of February, the Amir brothers - Yossi and Shlomi - completed their takeover of the company, and since then have carried out efficiency measures that included the dismissal of 150 headquarters employees and presented strong financial results.

Ranked second in the index is Teva Pharmaceutical Industries Ltd, which jumped 91% announcing strong results and positive forecasts. Investors' optimism returned to invest in Teva, which was previously considered the queen of the Israeli stock market, leading it to a record of more than five years, and returning to its former glory. It was placed among the three leading Israeli companies with the highest value on Wall Street.

The third in the index during the war is the Nova share, which operates in the field of semiconductors. Nova soared 81.9% in the past year, as part of the booming AI market that boosted chip stocks around the world. It is followed by Tower Semiconductors, which jumped by 80.2%, also operating in the same sector.

The stock that recorded the most negative return in the Tel Aviv 35 index since the onset of war is the Strauss stock. Strauss, the Israeli food giant, lost 27.3% of its value in view of its financial results, as it was attempting to return to its previous market share in the candy sector, before the recall and the shutdown of its Nof Hagalil factory to investigate salmonella contamination.

Other losing companies are ICL and Shapir Engineering, which shed 23.8% and 19.9% of their value, respectively.

Get the Ynetnews app on your smartphone: