The researchers digging through the bankruptcy documents of FTX, the crypto exchange founded by Sam Bankman-Fried, discovered something surprising. One of the plans of the former billionaire was the purchase of no less than a country.

Read more:

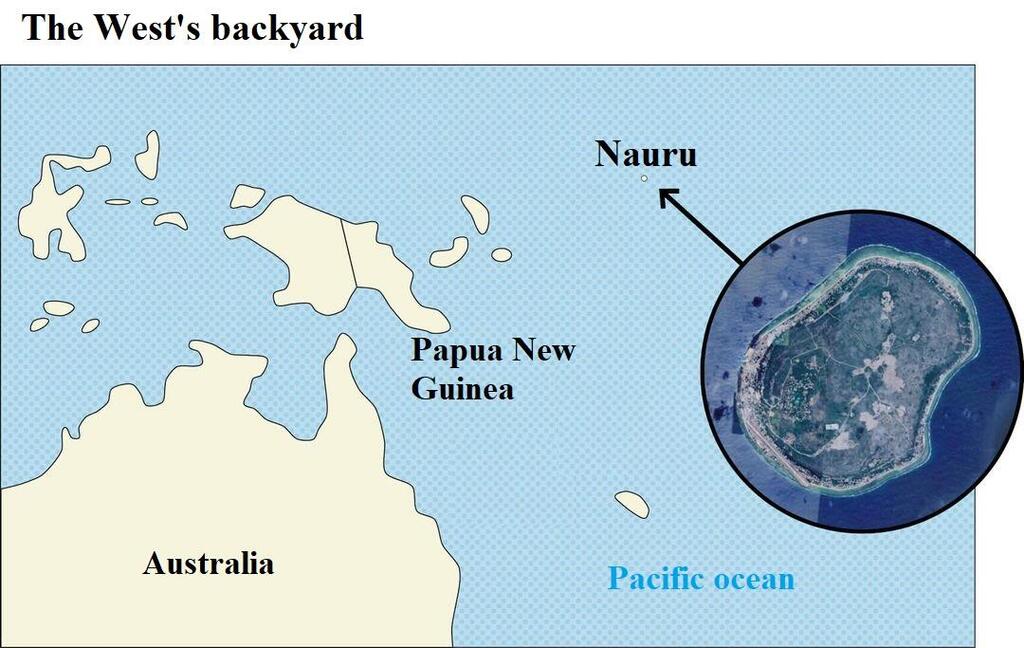

"Apparently there are things to do with a sovereign state," wrote Bankman-Fried's brother, Gabe, to the head of philanthropy at FTX. Bankman-Fried was talking about Nauru, the smallest island nation in the world, located in the South Pacific Ocean. He hoped to build a doomsday bunker in its territory, to ensure that his members of the effective altruism movement would survive in the event of "50-99.99% of the world's population would die", and wanted to foster "wise regulation around human genetic improvement."

Bankman-Fried planned to buy Nauru using his profits from the crypto empire he founded. In its heyday, until almost a year ago, the value of FTX was estimated at $32 billion, and the wealth of its founder was estimated at $26.5 billion. At the time, Sam Bankman-Fried was considered the billionaire who amassed his fortune the fastest in history. The media called him "the next Warren Buffett", and one of his biggest investors - the veteran and respected venture capital fund Sequoia - estimated that he would be "the first trillionaire in the world".

Bankman-Fried and his younger brother Gabe, who was the dominant lobbyist for FTX, were active in two ideological movements—effective altruism, which advocates that the most important moral imperative is to earn as much money as possible in order to donate it, and longtermism, whose members believe that the highest ethical duty is to act to increase humanity's ability to survive in thousands of years, among other things through the settlement of the consciousness of our descendants in distant galaxies.

According to The Economist, in 2022 Bankman-Fried alone invested more than $130 million "into projects aimed at securing the long-term future of humanity" through the FTX Future Fund, which was also managed by his brother Gabe. According to some estimates, the movement itself has raised more than $30 billion in recent years from billionaires including Elon Musk, Peter Thiel and Jaan Talllin, who are preoccupied with the "existential dangers" which are posed by murderous robots.

Today there are those who define the effective altruism movement as having cult characteristics. The movement's close connection to Sam Bankman-Fried did not help its reputation, after it became clear in the fall that the tens of billions of dollars he earned were obtained, according to the indictment filed against him, through embezzlement, a pyramid scheme, money laundering and defrauding investors. Bankman-Fried, whose release on bail was revoked last week until the start of his trial, will probably no longer buy the island state of Nauru.

A country of unhealthy people with a lifespan of 64

There are not many people who can testify that they thought of acquiring a sovereign state, or that they acted to complete such a move. It is true that there was a period in modern history when sovereignty over a country was considered an economic commodity, but it was mainly a method of countries to take control of territories, not of private individuals.

The United States is a prominent example: in 1803 it purchased Louisiana from France, in 1819 Spain sold its sovereignty over Florida, in 1845 it acquired control of Texas, and three years later it purchased parts of California, New Mexico and Utah from Mexico. In 1867, the United States concluded the shopping spree with the purchase of Alaska from Russia. The Spanish, on the other hand, sold the Philippines and Puerto Rico, the British paid rent for Singapore and leased Hong Kong for 99 years, and China received part of Tajikistan's sovereignty in 2011 in exchange for investments in the region.

If you compare Nauru to the oil deposits in Alaska, the favorable climate in Florida, or the geographical importance of Hong Kong, the choice is less obvious. The country, with its 21 square kilometers and 12,000 inhabitants, has a shortage of fresh water, it has almost no arable land left and it imports 90% of its food.

Dependence on processed food has led its population to be one of the fattest and sickest in the world, with half of its citizens suffering from morbid obesity, a quarter of them suffering from diabetes, and the life expectancy of its residents a mere 64 years. This, without mentioning that Nauru is vulnerable to extreme weather phenomena, and the fact that it is far and isolated, somewhere between Australia and Hawaii.

Under these conditions, it is clear that those who seek to buy Nauru or take control of it are not interested in the country itself or the well-being of its inhabitants, but are busy with their own narrow interests. And Bankman-Fried is only the latest in a long list of nations and billionaires who sought to take advantage of the tormented island nation.

In fact, the case of Nauru radically illustrates the results of the meeting of unrestrained capitalism and a weak and dependent regime, and is an example of the long-term damage left behind by colonialism and the wealthy West's disavowal of the vibrant communities it exploited for its aggressive growth. This case also illustrates the importance of a stable regime that has the long-term welfare of its residents in mind, and the fact that resource wealth can become a curse if it is managed by corrupt hands.

'A bleak and shocking piece of land'

The island of Nauru was settled more than 3,000 years ago, and for thousands of years its inhabitants managed to live in isolation, independence and harmony with nature. In 1888, the island became a trading currency in the hands of superpowers, when Great Britain and Germany divided lands between them. In 1899, it was discovered that the interior and elevated part of the island, which the Nauru people called "Topside", was rich in resources, and in 1906 it became clear that the resource was phosphate. The Australians made a deal with the Germans, declared the island a "mining site", and began aggressively extracting resources from its land.

6 View gallery

The area in Nauru from which resources were aggressively mined and has not been restored since

(Photo: Reuters)

Until then, wild fruit trees and other domesticated crops grew in the interior of the island. The Australians cleared all the vegetation in it, scraped the top layer of soil and mined the phosphate from the pits and crevices among the ancient corals that were underneath. The impact was immediate, and in 1921 photographer Rosamond Dobson Ron described the consequences of mining on the island for National Geographic magazine: "A cultivated phosphate field is a bleak and appalling expanse of land. Thousands of white coral peaks stand 10 to 30 feet high," he wrote, adding: "Its cavernous depths are strewn with broken coral, abandoned electric tracks, discarded phosphate baskets and rusty American oil cans."

Australia exported the phosphate at a price lower than the world average to subsidize farmers in New Zealand, Great Britain and Australia itself - three countries that the League of Nations defined between the world wars as the "Phosphate Commission".

total of 80 million tons of phosphates left the island, or as researcher Peter Dauvergne described it in his award-winning book "Environmentalism of the Rich": "If garbage trucks could fly, this amount of phosphate could fill enough trucks to connect them, bumper to bumper, from New York to Tokyo and back." And all that phosphate, Dauvergne wrote, "came from an island a third the size of Manhattan."

A fraction of the capital flowed into a wealth fund established by Nauru, and in 1968, when the island nation finally gained independence, it took control of mining the resource. At first, it looked promising. A decade after it became a representative democracy and appointed its first president, Hammer DeRoburt, the GDP per capita in the country was one of the highest in the world, second only to the oil empire of Saudi Arabia.

Most of the island's inhabitants, then numbering 4,000 people, were not required to work and the participation rate in the labor market was 20%. In those years, Nauru's extravagance became notorious, when the country bought a fleet of Boeing 737 aircraft, provided free public services and avoided collecting taxes. In addition, almost every child on the island received a full scholarship to study in Australia, and the country even invested two million Australian dollars in a failed West End musical called "Leonardo the Musical - A Portrait of Love".

"With no resources and after its land was completely destroyed, Nauru did what any small island nation in its situation does - became a tax haven. In the nineties, its government granted a license to 400 foreign banks, which were not even required to open a branch on the island"

The world press used to note during the prosperity period the fondness of the people of Nauru for importing luxurious sports cars. Apparently a not unusual hobby among the newly rich, until you remember that the country has only one real road, which allows you to circle the island within an hour's drive and the speed limit on it is 25 miles per hour.

But the wealth was temporary. After less than two decades of independence and 60 years of mining, the phosphates in the island's soil were almost completely exhausted. Because no one bothered to rehabilitate the area, 80% of Nauru's land remained unfit for habitation and agricultural crops. A journalist who visited the island a decade ago described its landscape as a "moonscape" due to its being empty and shining in its center.

The prolonged Western exploitation, along with a deadly combination of corruption, extravagance and reliance on a single financial source, drained the country's wealth fund, its economy crashed and GDP collapsed. Today, Nauru is ranked 164th in the world in terms of GDP per capita - about $12,000 in 2022, compared to more than $50,000 in the 70s.

In 1987, the International Court of Justice (ICJ) ruled that Australia was responsible for extensive destruction of the island's lands, and in 1993, Australia agreed to pay compensation in the amount of 107 million Australian dollars to restore the land. In return, Nauru promised not to come to Australia with complaints ever again.

No phosphates? There are detainees

With no resources and after its land was completely destroyed, Nauru did what any small island nation in its situation does - became a tax haven. In the nineties, its government granted a license to 400 foreign banks, which were not even required to open a branch on the island.

6 View gallery

A demonstration in Sydney against the incarceration of refugees in detention facilities on Nauru and Manus Island, in 2017

(Photo: Reuters)

Then Nauru started selling citizenships. Its position as a tax haven and space for money laundering was so dominant that in 1999 international banks forbade doing dollar transactions with Nauru. The United States, for its part, identified it as a significant center for money laundering and banned American financial companies from doing business with it.

Nauru once again had to find a source of income, and in 2001 it found a new one: detention camps for refugees. It was agreed that Australia would build three refugee detention camps in Nauru in exchange for the payment of refugee visa fees, and the camps would also provide a source of employment for the island's residents. The detention facilities are operated by a private Australian company called Canstruct International, while the Nauruans are used as contractor workers.

It didn't take much to realize that the new source of income was also short-sighted, unproductive, leaving Nauru completely dependent on Australia. The entire move has been subject to consistent public criticism. Leading Australian economist Helen Hughes said in 2008 that Nauru could never stand on its own two feet, and that it should unite with Australia.

"They have a culture, a right to their language and all that, but they have no right to be supported forever by the Australian taxpayers, and that's what Nauru intends to do - to be an eternal beggar state"

"This is a state dependent on welfare, where education has been lost and no one works," she said unapologetically. "They have a culture, a right to their language and all that, but they have no right to be supported forever by the Australian taxpayers, and that's what Nauru intends to do - to be an eternal beggar state." A short time later the detention facilities were closed, only to be reopened in 2012.

A 2022 report by the Australian National University found that in 2019 and 2020, the income from the detention centers provided 58% of the Nauru government's budget, and that since they reopened, its income has jumped by 900%. According to a study by researcher Julia Caroline Morris published this year, the detention facilities industry in Nauru has become the driving force of the country's economy, and it employs more than 30% of the island's residents.

The criticism of the detention facilities did not stem only from their cost to the Australian taxpayer, but also from the claims that the countries are "outsourcing the refugee problem" and developing a "refugee industry". Australia itself has been reprimanded for engaging in "environmental racism" and Nauru has been unflatteringly dubbed a "refugee dump".

The negative image of the facilities led the Australian and Nauru governments to try to strictly control information about what was happening in them. In 2014, the government of Nauru increased the amount required to apply for a journalist's visa from 200 Australian dollars to 8,000 dollars, in order to suppress coverage of what is happening in the camps. It was to no avail, and in 2016 the "Guardian" obtained two thousand documents documenting a pattern of abuse at the facilities, which were published in what became known as the "Nauru Files". The island state was given a new nickname - "refugee hell".

Island-loving billionaires

When it was discovered last month that Nauru was in Bankman-Fried's crosshairs, the state responded with an unequivocal message: it was never for sale. But even if the country was not for sale, it had already sold its position as a sovereign country in the international arena. Two years ago, Nauru invoked a small and vague clause in the International Sea Treaty and aggressively pushed to start a resource mining industry in the deep waters of the oceans. It has done this even though it itself does not possess the factories, tools or skill to extract resources from the depths of the sea.

Why did it still choose to do this? Behind the move was a private Canadian company called The Metals Company (formerly DeepGreen), which tried for years to obtain permits to operate heavy machinery in the depths of the sea and mine ores. But because the sea does not belong to any person or country, decisions concerning it are made through dialogue between nations.

The Metals Company is not one of them, so it persuaded Nauru to invoke the clause for it, and then used Nauru's right of speech to apply to the International Authority for the Regulation of Activities on the Seabed in International Territories (ISA). In return, the company committed to pay Nauru two dollars per ton "mining production fee", or less than 0.5% of the estimated value of the material it will mine. A bad deal by all accounts, but Nauro had no choice. When Nauru's ambassador turned to ISA, it said exactly that - the country needs approval because it has almost no revenue.

But it turns out that even in the situation that Nauru has reached, it is possible to count on eccentric billionaires, crypto enthusiasts who are preparing for the end of the world, that are looking for small, failed islands to build autonomous enclaves where they will not have to pay taxes. Bankman-Fried was not the first billionaire to ask to do this. In 2015, billionaire Peter Thiel initiated the Seasteading movement, which is dedicated to building independent floating cities in the open sea. The group's first failed project from 2017, an autonomous enclave in the sovereign waters of French Polynesia, was financed through the issuance of dedicated cryptocurrencies.

In the same year, the Czech libertarian Vít Jedlička declared sovereignty over a narrow section of seven square kilometers on the banks of the Danube between Croatia and Serbia as a sovereign state called Liberland. The government of Liberland (which no country recognizes) operates on the basis of the Polkadot blockchain project. In 2021, some crypto entrepreneurs leased the island of Satoshi, named after the inventor of Bitcoin, from the state of Vanuatu, a small island in the Pacific Ocean, where they plan to build the "world's crypto capital" and create a "blockchain-based democracy".

In contrast, Bankman-Fried was much more ambitious. Why lease or try to build a floating island, when you can buy an entire country - with "things" to do with it. The idea, which sounds far-fetched, expresses the parallel reality in which the ultra-rich technology barons live. Giddy and full of disruptive arrogance, they believe that money makes everything possible: including buying Nauru, the punching bag of the Western world from 1888 and the country that has nothing left to sell but itself.