Getting your Trinity Audio player ready...

Wiz's sale to Alphabet, Google's parent company, for a record-breaking $32 billion — the largest deal in the history of Israeli high-tech and also a milestone for the American tech giant—takes us back through the history of major acquisitions of Israeli startups. From the memory card maker in Kfar Saba to Galileo and Mobileye, here are the highlights:

M-Systems from Kfar Saba sold to SanDisk for $1.5 billion

In the summer of 2006, SanDisk, the American flash memory provider, acquired M-Systems from Kfar Saba for $1.55 billion. Founded in 1989 by entrepreneur Dov Moran, M-Systems was a trailblazer in developing memory cards to replace floppy disk drives, with its Disk-On-Key product.

Cybersecurity company Forescout sold for $1.9 billion

In February 2020, the Israeli-American cybersecurity company Forescout was sold to the American private equity firm Advent International for $1.9 billion. "I want to thank our customers, partners, shareholders, and, of course, our more than 1,100 employees. Looking ahead, we are confident this deal marks a significant milestone that will help us build on our strengths," said Forescout CEO Michael DeCesare.

Forescout was founded in 2000 by three entrepreneurs: Professor Hezy Yeshurun, Oded Komay, and Doron Shikmoni. In 2017, the company went public with a valuation of $800 million.

$2 billion for Habana Labs

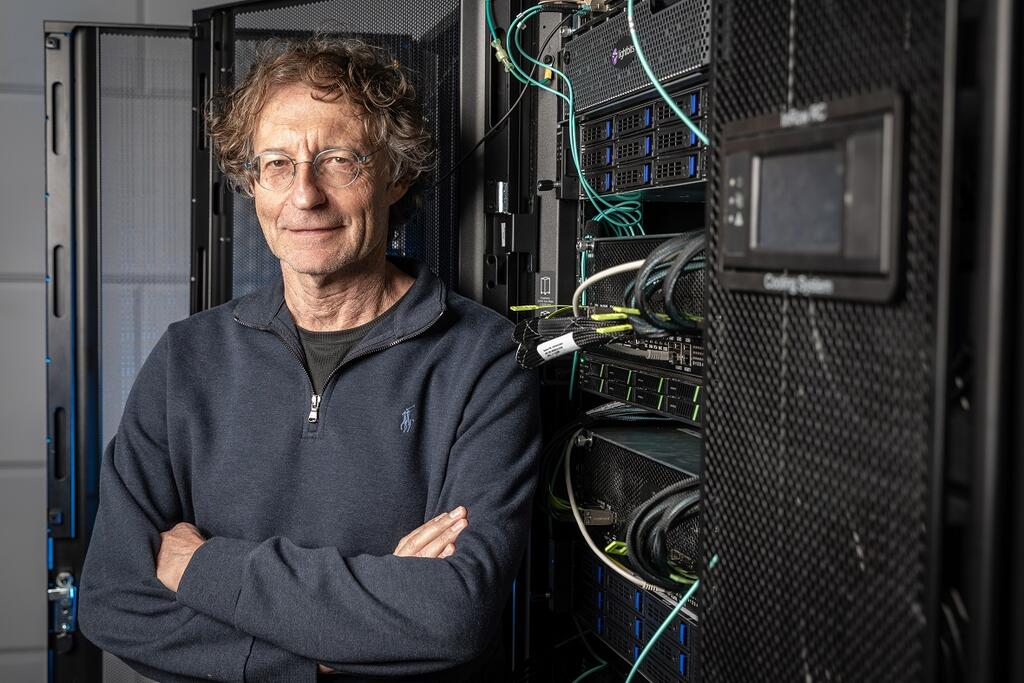

At the end of 2019, Intel acquired Habana Labs for $2 billion. The company developed a chip designed for artificial intelligence applications. Intel was already familiar with Habana, having participated in one of its fundraising rounds a year earlier. Founded in 2016 by David Dahan and Ran Halutz, Habana Labs aimed to maximize AI's potential by significantly improving processing performance, costs, and power consumption. "We are fortunate to know Intel and to work with them through their investment in Habana, and we are excited to officially join the Intel team," said David Dahan, CEO of Habana Labs. "Intel has built a world-class AI team, and we are thrilled to collaborate with them to accelerate and expand our activities. Together, we will deliver even greater innovation in artificial intelligence and faster than ever."

$2.7 billion for Galileo

Around 24 years ago, the Israeli high-tech company Galileo, which developed and manufactured chips for communication networks, was acquired by the American communication chip manufacturer Marvell for $2.7 billion. The man behind the deal was Avigdor Willenz, who also founded Habana Labs. According to reports, Willenz, who owned 21% of Galileo’s shares, received stock worth about $500 million as part of the transaction.

Mercury sold to HP for $4.5 billion

Mercury, which provided software services for managing information systems, was sold in July 2006 to the American giant HP for $4.5 billion. At the time, it was considered the largest cash acquisition of an Israeli company. Before being acquired by HP, Mercury had itself acquired several companies. At its peak, the company employed about 2,700 people, 750 of them in its research and development center in Yehud.

<< Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv >>

Sold for $4.5 billion but hit by the dot-com crash

Chromatis, which developed technology to improve data transmission over optical fibers, was sold in May 2000 to Lucent for $4.5 billion, despite having no significant revenue or sales at the time. Just over a year after the acquisition, following the dot-com bubble burst, Lucent decided to abandon its significant investment in the Israeli company and shut down its division.

Cisco paid $5 billion for NDS

In 2012, NDS, a Jerusalem-based company that developed encryption and digital rights management systems to protect television broadcasts, was acquired by the American communications giant Cisco for $5 billion. At its peak, NDS employed about 1,000 people in the Har Hotzvim industrial area, northwest of Jerusalem. However, like other companies on the list, the merger did not fare well for NDS, and its operations were significantly downsized, with many of its employees laid off over the years.

NVIDIA beat Intel in March 2019

In March 2019, Mellanox, founded by Eyal Waldman, was acquired by NVIDIA for $6.9 billion, making it the largest acquisition in the history of the chip giant. Intel also tried to acquire the Israeli company but offered $900 million less than NVIDIA. Mellanox developed and manufactured chips and communication components for high-speed data transfer. "NVIDIA and we share a common vision to accelerate computing," said Waldman. "The combination of our two companies is a natural extension of our long-standing partnership, and it fits particularly well with our performance-driven culture. This combination will support the creation of powerful technologies and fantastic opportunities for our people."

Mobileye to Intel for $15 billion

The largest exit in Israeli high-tech history, until Wiz’s acquisition by Google, was Mobileye’s $15 billion sale to Intel in 2017. Mobileye, founded by Amnon Shashua in 1999, developed and sold systems capable of warning drivers about the proximity of nearby vehicles and helping prevent collisions. The system could also detect unusual driving patterns and alert the driver.

The acquisition marked Intel’s strong entry into the autonomous vehicle sector. "This acquisition is a significant step for both our shareholders and the automotive industry as well as consumers," said Intel's then-CEO, Brian Krzanich. "Intel provides foundational technologies for autonomous driving, including real-time vehicle routing and decision-making. Mobileye brings the best computer vision capabilities in the automotive industry along with its strong momentum in the market of car manufacturers and suppliers. Together, we can accelerate the future of autonomous driving with improved cloud-to-car solutions at reduced costs for automakers."