Getting your Trinity Audio player ready...

Omri Casspi, former NBA player turned venture capitalist, has raised $60 million in seed capital to invest in early-stage startups founded by serial entrepreneurs in industries where Israeli innovation excels, including cybersecurity, cloud infrastructure and artificial intelligence.

The former Israeli national basketball team captain is shifting his focus to Swish Ventures, his new seed-stage venture capital fund he describes as a "direct continuation" of his successful partnership with veteran early-stage investor David Citron at the Sheva fund, which he also co-founded.

The fund plans to invest in around 10 startups, with deals ranging from $5 to $7 million per investment. Among the fund's investors are Sequoia, Israeli and American institutional investors, serial entrepreneurs and notable figures such as Ophir Ehrlich (founder of EON), Gal Ben-David (founder of PointFive), Amiram Shachar (who sold a company to Netapp and is a co-founder of Upwind), Asaf Ezra (who sold Granulate to Intel), Yevgeny Dibrov and Nadir Izrael (co-founders of Armis), Michael Dolinsky, Zohar Alon and others. The fund manages a total of $125 million in assets.

But, much like his sports career, Casspi is aiming high. He told Ynetnews that he and his partners are targeting "massive markets." How massive? "Potential $10 billion-plus companies," he said.

"We want to back the best teams in big categories who can dominate their markets. Beyond the team, we target substantial markets where we can envision the company becoming a category leader. Examples from Sheva include EON, Upwind and PointFive—companies with the potential to reach valuations of $20–40 billion if executed well."

Acknowledging the challenges foreign investors face when considering a country at war, Casspi describes Israel's high-tech sector as an "ambassador for Israel during these challenging times."

4 View gallery

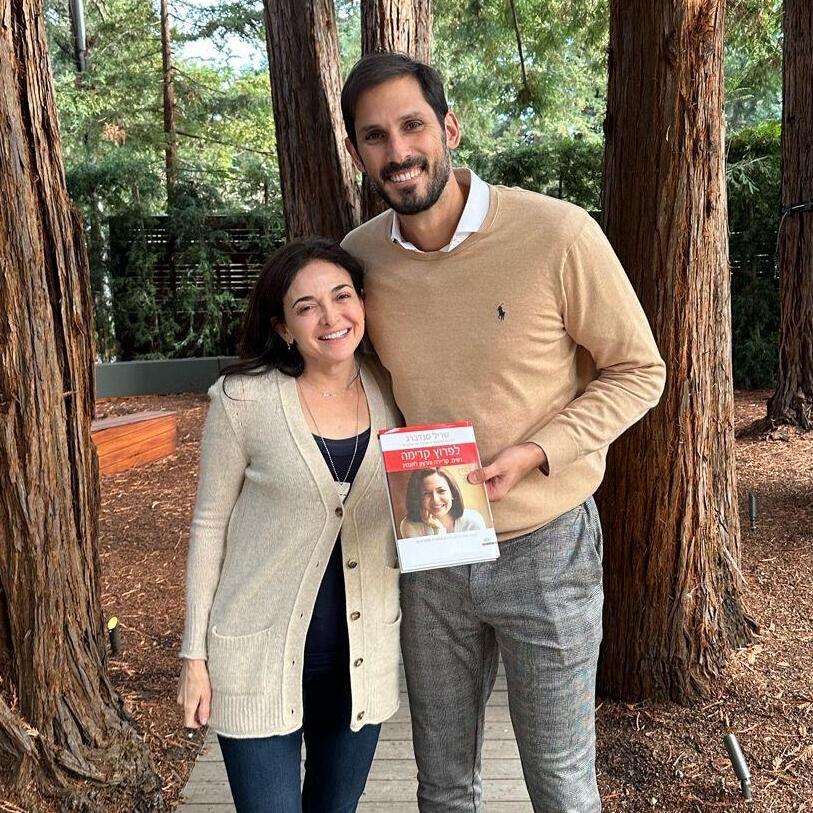

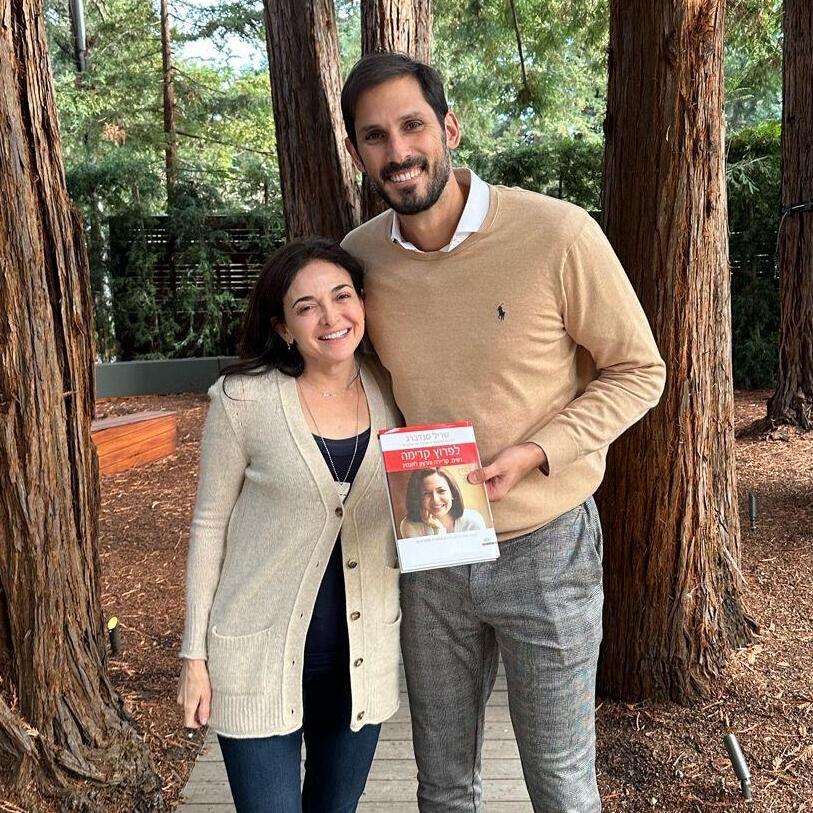

Former Israeli NBA player Omri Casspi (right) with former COO of Meta Sheryl Sandberg

(Photo: Courtesy)

"I call it 'Zionism 2.0,'" he said. "It’s about helping the country, the hostages and Israel’s high-tech industry. We leverage our connections in the U.S. to open doors for our companies.

"We have also partnered with Sheryl Sandberg, former COO of Meta and a board member of some of the largest companies in the U.S., to expose facts about Hamas' crimes that she has shared worldwide. Through the industry's network, we had the privilege of participating in raising significant donations for the rehabilitation of communities in the Gaza border region. The high-tech infrastructure allows us to serve national interests and is more important than ever."

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

In November of last year, shortly after the outbreak of the war, Casspi helped bring tech mogul Elon Musk to Israel. The billionaire met with Israeli leaders, including Prime Minister Benjamin Netanyahu and President Isaac Herzog, and also toured Gaza border communities devastated by terrorists in the October 7 attack.

4 View gallery

Elon Musk visits a Gaza border community ravaged by Hamas-led terrorists on October 7; Casspi is seen standing in the background to the left

(Photo: Amos Ben Gershom/GPO)

"When I brought him to Israel after October 7, it was important for him to see things firsthand and become Israel’s best friend, and of the Israeli market and the hostages, and to bring it all to the forefront," he said.

"He also owns a highly influential social media platform and his help in combating fake news against Israel is invaluable."

During a visit to the Auschwitz concentration camp in January, Musk presented a dog tag calling for the release of the hostages he had received during his visit to Israel. Musk pledged to carry the tag until all the hostages are freed.

Despite two tumultuous years for Israel’s economy, marked by war and widespread street protests against the government's intention to enact sweeping reforms of the judiciary beforehand, Casspi remains optimistic about the resilience of the country’s high-tech sector.

"Since early 2024, global funds have participated in 40 seed rounds here," he said, noting the resilience of seed-stage investments despite struggles in later-stage funding due to high valuations and interest rates. Casspi emphasized that Israel’s startup ecosystem remains competitive, with increasing involvement from U.S. funds. "We aim to build alongside them," he added.

Casspi highlighted Israel’s rise as a global startup hub, positioning itself as the second-largest ecosystem after the U.S. "Tel Aviv has become a major player," he said, attributing this growth to a maturing market and the return of seasoned entrepreneurs launching second and third ventures.

Reflecting on his transition from basketball to venture capital, Casspi described the move as a bold leap. "I saw it as a huge challenge," he said. "After 25 years in basketball, 16 as a professional, I decided I wanted to start fresh in a new industry. I took the plunge and was truly fortunate to encounter amazing entrepreneurs, an incredible community and an outstanding industry—whether investors, entrepreneurs or colleagues who showed me the way, opened doors and took pro-bono meetings to offer helpful advice."

For newcomers to the tech and venture capital world, Casspi advised persistence and a focus on carving out a unique niche. "Where there’s a will, there’s a way," he said. "I started like a baby learning to crawl, asking questions—even foolish ones." He stressed the importance of passion, standing out and building relationships, adding, "I didn’t want to be just ‘the basketball player dabbling in investments.’ I stayed focused on helping entrepreneurs and creating a unique niche. That’s been key from the start."