Getting your Trinity Audio player ready...

Lusix, the synthetic diamond company founded by Benny Landa, is on the brink of filing for insolvency. The company has informed its creditors of its intention to do so, though the timing remains uncertain.

Sources have told Calcalist that Lusix informed its shareholders last week that it urgently needs to raise $15 million to continue operations. Without this capital infusion, the company will likely become insolvent. Although some investors have considered providing additional funds, it is not believed that this has materialized.

Lusix, like the broader synthetic diamond market, has been hit hard by a sharp decline in raw material prices. The price of synthetic diamond material has plummeted from $300 to $30 per carat in recent years, leading to the closure of several companies worldwide unable to weather the crisis, even as consumer prices for lab-grown diamonds have remained relatively stable.

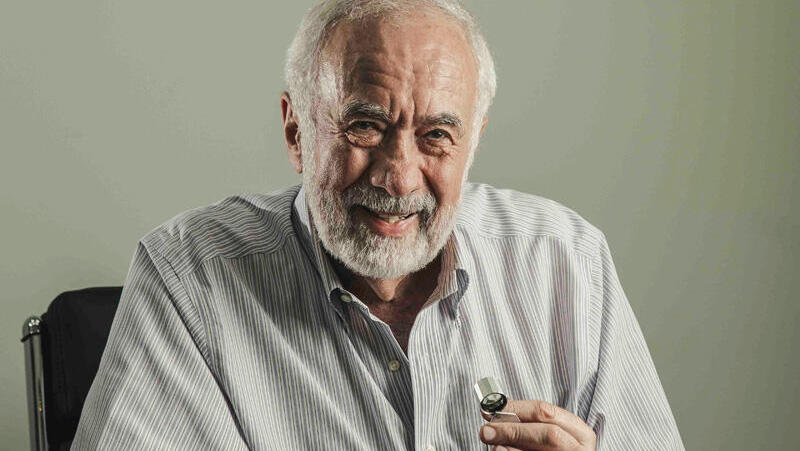

Founded in 2016 by Landa, who previously sold digital printing company Indigo to HP for $830 million in 2002, Lusix produces laboratory-grown rough diamonds. These diamonds are sold to polishers who transform them into finished products for various jewelry companies. Laboratory-grown diamonds are seen as a more environmentally friendly alternative to natural diamonds, which are often associated with environmental damage and human rights abuses, particularly in conflict zones where they are dubbed "blood diamonds."

Landa, who serves as Lusix's chairman, has invested approximately $60 million of his own money in the company over the years and solely financed the company until mid-2022. Other shareholders include More Investment House and the Ragnar Crossover Fund, with the most prominent being fashion giant LVMH, which led a $90 million funding round in 2022.

In late 2023, Lusix raised $15 million, based on a valuation of just $50 million, which has kept the company afloat until now. Lusix, headquartered in Rehovot, is now aiming to transition into producing polished diamonds in a last-ditch effort to save the business. Benny Landa, whose wealth is still estimated to be over a billion dollars, also owns Landa Digital Printing, a 3D printing company valued in the billions. Lusix's current troubles suggest that Landa may have given up on his vision of revolutionizing the synthetic diamond industry.