Getting your Trinity Audio player ready...

Selina Networks filed for bankruptcy on Monday, citing a 95% drop in stock value since its IPO, massive debts, and an inability to meet financial obligations with its investors, the company informed the Inter-American Development Bank.

Listed on NASDAQ 18 months ago with a valuation of $1.2 billion, Selina's stock price has plummeted by 99%, leaving the company valued at about $20 million. Facing potential delisting from NASDAQ, the company's stock price has fallen below the minimum threshold.

"The company's board has appointed a trustee to sell all of Selina's subsidiaries worldwide. We expect to identify the buyer in the coming weeks," Rafi Museri, founder of Selina, told Ynet. "We've faced tough challenges: COVID-19 left us with a $150 million debt, and just as we were recovering, a war broke out in Israel."

The Inter-American Development Bank (IDB), which provided a $50 million loan to the company in 2020, informed Selina that it failed to meet loan conditions, including missing $450,000 in interest payments due on July 15. The company ended 2023 with a $200 million loss and a capital deficit of $735 million.

Notable investors such as Adam Neumann, founder of WeWork, businessman Len Blavatnik, venture capitalist Gigi Levy, and others have investments at risk. Selina operates 107 sites worldwide, including 14 in Israel in partnership with the Hagag Group, which has written off over 6 million shekels due to Selina’s financial difficulties and deferred debt payments.

Selina’s rapid expansion, particularly into urban centers worldwide where it lacked a competitive edge, significantly contributed to its financial distress. Despite these challenges, Selina announced a strategic partnership with Osprey, which invested $35 million targeting Selina’s core audience of students and young people. However, this investment proved insufficient. Selina also implemented a recovery plan, closing 11 unprofitable sites and laying off 350 employees.

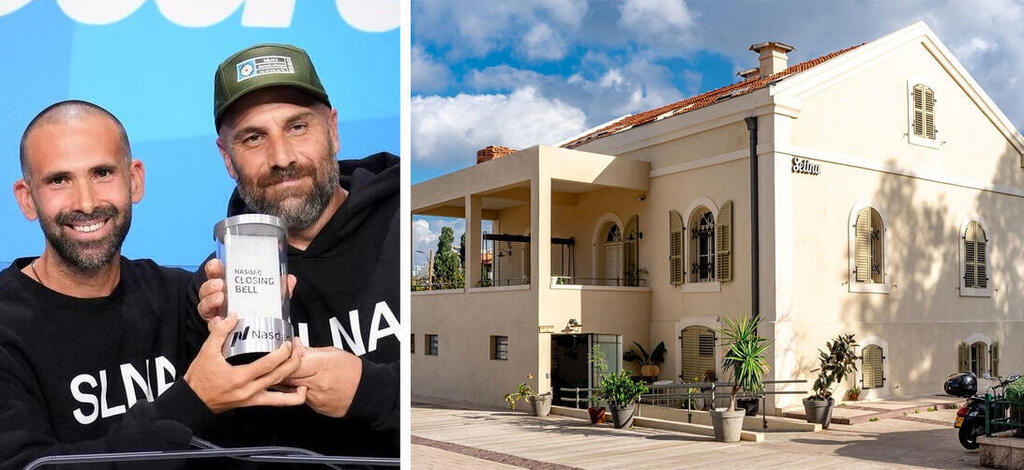

The bankruptcy request has shattered the success story of two former IDF soldiers who transformed a shabby hostel in Panama into a digital nomad's haven, expanding across South America.

Critics argue that flawed management, focusing on expansion at the expense of profitability, and the owners' lack of experience in hotel operations were key mistakes. A senior Israeli hotelier commented, "When you're on a hammock at a Selina beachfront, everything looks great, but when you're in a hotel in London, your demands are completely different."

Many Selina sites are leased from property owners, such as the Hagag Group in Israel, which located, renovated, and leased six sites to Selina, including a holiday village at the Kinneret. Selina reported to U.S. capital authorities and investors that the American bank providing the loan holds guarantees against Selina's hotels, meaning the sale process cannot include all 107 of its hospitality sites worldwide.