Getting your Trinity Audio player ready...

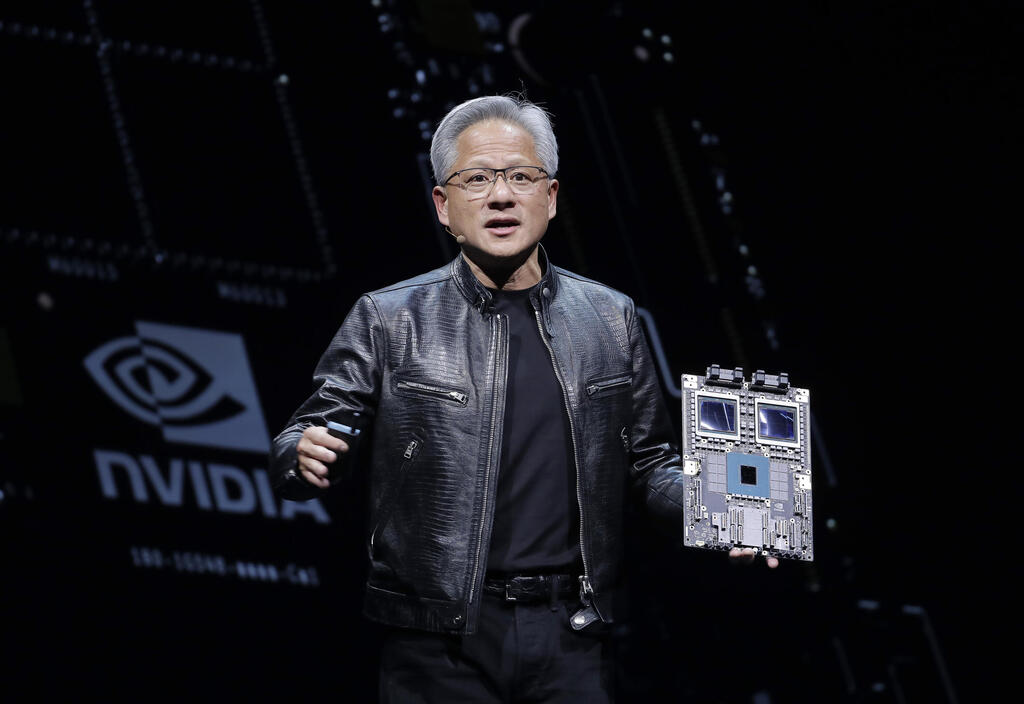

At the CES technology and innovation expo in Las Vegas, Israeli companies Innoviz Technologies and Arbe Robotics made headlines with partnership announcements involving Nvidia, the AI chip giant. Both firms are integrating their cutting-edge sensor technologies into Nvidia's autonomous driving platform, triggering significant stock market reactions.

Innoviz, a leader in LiDAR sensor technology, will see its sensors incorporated into Nvidia’s DRIVE AGX Orin platform, allowing autonomous vehicle manufacturers using Nvidia’s system to enhance environmental perception. Arbe Robotics, specializing in radar systems, also announced a collaboration with Nvidia to bolster its offerings for vehicle manufacturers.

The announcements led to immediate investor enthusiasm. Innoviz shares soared 30% to a record high of $3.10 following the news, with trading volumes more than ten times the three-month average. Despite subsequent corrections, the stock remains up 350% compared to its value a month ago.

Similarly, Arbe’s shares climbed 50% on Tuesday, marking a 150% increase over three months, as investors rallied behind the potential of its radar technology in Nvidia’s ecosystem.

The partnerships represent strategic wins for both Israeli firms. Innoviz's advanced fifth-generation LiDAR sensors offer high-resolution 3D imaging, enhanced performance in adverse weather and improved object detection. The collaboration opens doors to new automotive clients previously out of reach. Arbe’s radar technology, lauded for its accuracy and reliability, positions the company for broader adoption in the growing autonomous driving sector.

These developments reflect the so-called "Nvidia effect," where companies announcing collaborations with the AI powerhouse often see heightened investor interest.

Everyone wants to partner with Nvidia

Arbe Robotics' story mirrors that of Innoviz: while its technology is already mature, the real breakthrough lies in integrating its radar sensors with Nvidia’s platform. Arbe’s radar chip, which uses radio waves, delivers ultra-high-resolution imaging of a vehicle's external environment, identifying even small elements that other technologies struggle to detect. With this integration, Arbe's chip becomes part of Nvidia's comprehensive "supermarket" for automakers, built around Nvidia's platform for autonomous vehicles.

According to a report by Insider Monkey, which analyzed eight of Nvidia’s recent partnerships, the collaborations with Israeli companies ranked highly in terms of impact for the firms and their investors. Arbe’s deal was ranked second, while Innoviz’s came in third—both ahead of partnerships with major names like Uber and Toyota.

Analysts note that Nvidia's soaring stock price has made investing in the AI giant a costly and potentially risky endeavor. As an alternative, companies partnering with Nvidia can benefit from its success while remaining attractive for investment.

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

For instance, Innoviz's stock has recovered only a fraction of its value lost since 2021, but optimism around autonomous driving and its AI-enhanced sensing and analytics capabilities has changed the narrative. Arbe's collaboration is expected to improve its financial performance and rekindle investor confidence, while Innoviz offers a gateway to the AI sector, bolstered by its Nvidia partnership and trading at less than five times its earnings.

Both Israeli firms aim to use this momentum to reverse their recent valuation declines. Arbe, currently valued at $291 million, remains well below its $500 million valuation during its SPAC merger three years ago. Innoviz, the first Israeli company to go public via SPAC at a $1.4 billion valuation, now trades at a market cap of just $294 million.

Ultimately, the future of these companies depends less on investor enthusiasm and more on the business opportunities they can generate through strategic partnerships—especially with Nvidia, which could become a defining factor in their growth trajectories.

Mobileye joins the race

To grasp the significance of Innoviz and Arbe's recent announcements, it’s essential to consider another Israeli player in the autonomous driving arena: Mobileye. At CES, Mobileye showcased its comprehensive autonomous driving platform across an impressive 650-square-meter exhibition space, reflecting its global stature. However, that status is increasingly challenged by Nvidia’s aggressive entry into the sector.

Mobileye’s platform, among the most comprehensive available, includes mapping software, a suite of cameras, radar and LiDAR sensors and four in-house autonomous driving processors. Automakers such as Volkswagen use this platform to produce autonomous cars, taxis and delivery vehicles.

Nvidia’s competing platform, centered on its powerful chips, offers a modular approach, allowing automakers to choose supplementary components from a range of partners—including Innoviz and Arbe, among others. Innoviz previously collaborated with Mobileye after the latter ceased its internal LiDAR development. However, Innoviz's recent partnership with Nvidia signals a more significant shift, raising questions about its future ties with Mobileye.

Innoviz has reported consistent business activity in recent quarters, including multi-million-dollar revenues and reduced cash burn. The company has secured deals to supply its sensors to automakers like Volkswagen and BMW. While its collaboration with Nvidia adds prestige, it remains one part of its broader business operations.

In August, Innoviz raised $65 million on Wall Street, offering shares at a 20% discount below market value—a move that displeased existing investors but ensured continued operations amid liquidity concerns. Other cost-cutting measures included laying off 13% of its workforce last year. Recent revenues, including $40 million expected in 2023 and another $40 million by 2027, have bolstered investor confidence, reflected in a rising stock price.

Arbe also announced this week that a top-10 global automaker selected its radar chip system for integration into mass-production models. Arbe anticipates this deal will lead to further agreements with other major automakers. The company recently dual-listed its shares on the Tel Aviv Stock Exchange alongside its Nasdaq listing and issued convertible bonds worth approximately NIS 113 million ($30.5 million). With its financial foundation solidified, Arbe now aims to deliver on the market’s high expectations.