The passenger doors on the jumbo jet were just too small. So engineers at Israel’s main airport sliced a new hole the size of an SUV into the side of the fuselage — and hoisted a massive hatch into place.

In many ways, it’s the doorway to the post-pandemic future of the battered airline industry.

6 View gallery

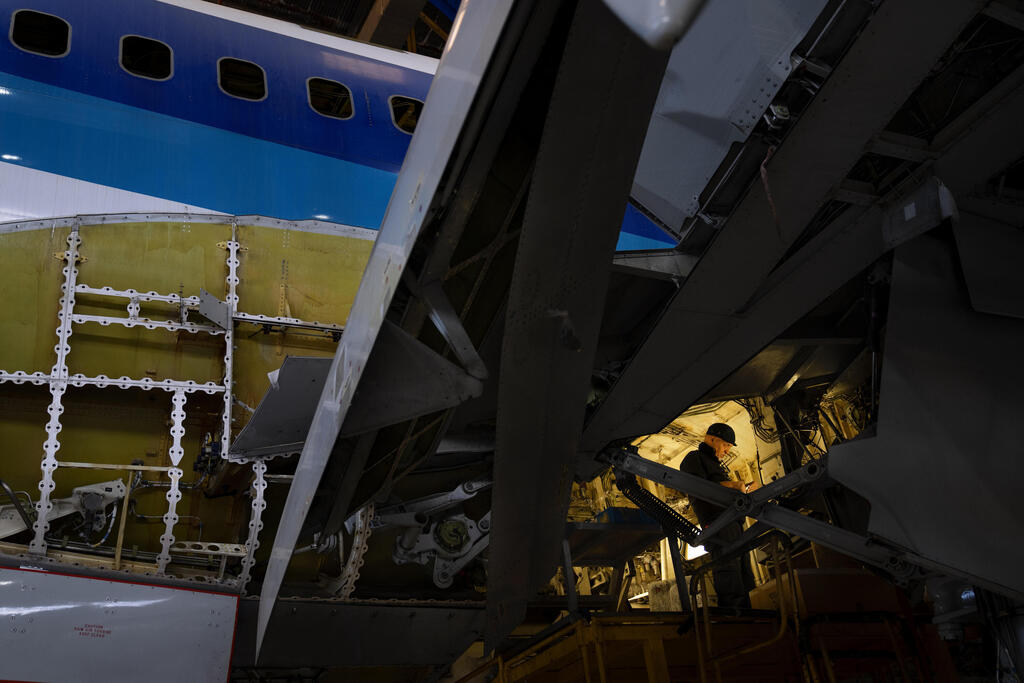

Engineers work on the conversion of a Boeing 767 passenger plane to a cargo plane

(Photo: AP)

As global tourism struggles to its feet after two harrowing years of coronavirus restrictions, Israel’s state-owned aerospace company is cashing in on the growth of e-commerce by converting grounded passenger planes into cargo jets for global giants like Amazon and DHL. The work reflects what analysts think is a permanent, pandemic-driven boom for shipping the stuff people buy.

To adapt, Israel Aerospace Industries early in the pandemic sped up and expanded what amounts to its assembly line. The sales pitch: At about $35 million an aircraft, the metamorphosis is a bargain compared to buying a new cargo plane four or five times that price. Now, the company says, it transforms about 25 planes a year, up from about 18 annually before the onslaught of COVID-19.

The company has emerged as a top player in this market, competing with others like Boeing. Its numbers continue to grow, and IAI officials say orders are booked for the next four years.

“This is about the relationship between passengers and cargo and pandemic,” said Shmuel Kuzi, executive vice president and general manager of the company’s aviation division. He says IAI now converts Boeing 737s and the much larger 767s.

Next year, the company expects to convert even bigger 777s — the first in the world, he says, with the work at a new plant in Abu Dhabi. That’s partly a result of the U.S.-brokered “Abraham Accords,” which formally established relations between Israel and the United Arab Emirates. And it’s a sign, Kuzi says, of the demand for converted jumbo jets.

Analysts say the explosive growth in online buying is likely to settle a bit as the pandemic wanes, inflation rises and people spend less time at their laptops. But the cost of shipping goods, exacerbated by tangles in the supply chain, is expected to challenge even the largest businesses. Amazon, for example, pointed in part to rising shipping costs when it boosted its Prime membership on Feb. 18 from $119 to $139.

E-commerce jumped by double-digit percentages at the start of the pandemic, accelerating a trend driven by shutdowns that kept people inside. Instead of traveling, people ordered online and expected speedy doorstep service.

That’s a big part of the reason that demand for cargo planes has held up throughout the pandemic.

Before the crisis, 50% of all global air cargo traveled in passenger planes. But when the pandemic began, some 80% of passenger planes stopped flying. The price of freight shipped by sea soared.

Air freighters needed a workaround — and grounded passenger planes provided one.

Eytan Buchman, chief marketing officer of Freightos, a Jerusalem-based booking platform, said one of the easiest and most cost-effective ways to increase capacity was converting passenger planes into freighters.

6 View gallery

A Boeing 767 is undergoing conversion from a passenger plane to a cargo plane

(Photo: AP)

Meanwhile, people and businesses are expected to keep up their online buying.

“People are still stuck in the mindset of, ‘I want to buy more goods,’” Buchman said. But he expects a “rebalancing” as the pandemic subsides.

For now, even as air travel begins to rebound, the number of passengers flying remains far below pre-pandemic levels.

“We don’t anticipate passenger network recovery to be for several years,” said Glyn Hughes, director general of the International Air Transport Association. Air cargo demand, he said, is expected to grow by as much as 5% per year.

The International Trade Administration, part of the U.S. Commerce Department, forecasts that worldwide e-commerce sales will continue to grow steadily by about 8% per year through 2024.

Richard Aboulafia, managing director of Michigan-based Aerodynamic Advisory, a consulting firm, said that while demand for refitted planes is robust, there is a danger that IAI and others are betting too heavily on the market. “There’s that risk of, will demand stay high?” he said.

Through 2025, Kuzi says, IAI is booked with conversions, a sprawling engineering and technical process that takes about three months. The company earlier this month announced it had completed its 100th conversion of a 767-300. IAI, Kuzi said, leads the world’s conversions of that model.

The transformation involves much more than removing seats and installing new doors.

On a recent day at the company’s campus a few miles (kilometers) from Ben Gurion International Airport, three hulking 767s stood in different stages of transformation. The air whirred with drills, the rush of ventilation and the clang of equipment being installed or removed.

Outside the hangar, workers carted blue leather passenger seats away from one jetliner, formerly owned by Delta, that had just arrived and parked on the tarmac. A pile of yellow oxygen masks, tubing and ceiling panels grew on a jetway as workers emptied the fuselage, which bore an American flag. At the front of the dark, cool interior, the first class section and the cockpit stood — for the moment — nearly intact, a testament to how that space had been used in what’s become known as the “before times.”

Two more 767s inside a nearby hangar offered glimpses of the next steps in the conversion process.

Both behemoths stood on specially made stands, surrounded by scaffolding several stories high.

The opening for the new cargo door gaped. Inside, engineers and technicians installed a new floor and panels along the walls. Another crew rewired the cockpit. The only sign it had ever served another purpose was a red maple leaf spanning the tail and faded letters spelling “Canada” emblazoned in red across the fuselage.

When it’s done, the plane and all others like it will be able to carry about 60 tons of goods on two floors.

Everyone cleared away while a crane on the ceiling, attached to a pulley and cables, hoisted the five-meter-wide (16.5-foot-wide) cargo door toward the opening. Two men in a cherry picker, engine roaring, guided the door from the floor up to the fuselage and into place.

“The pandemic makes the e-commerce very, very popular,” Kuzi said. “So in this case, it was a good thing for us.”