Getting your Trinity Audio player ready...

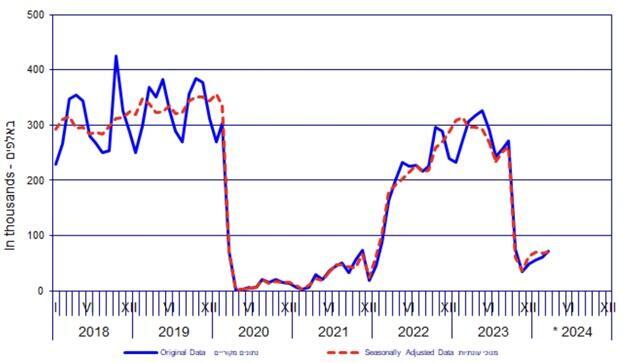

Tourism in Israel is still in a slump, after a significant downturn in the fourth quarter of 2023 according to data from Israel’s Central Bureau of Statistics. The reopening of Terminal 1 at Ben Gurion Airport and restarted operations from low-cost airlines might help reverse that trend, bolstering Israel’s struggling tourism sector.

Tourism is a vital sector in Israel, accounting for 2.8% of the country’s gross domestic product and about 3.5% of its total employment. Direct and indirect tourism jobs account for about 6% of all jobs in Israel.

Israel’s tourism industry suffered during the coronavirus pandemic, but the industry was on the road to recovery before the October 7 attacks. Since the attacks, much of the tourism industry in Israel has experienced a shutdown reminiscent of the coronavirus era. But while COVID-19 affected the entire world, the Israel-Hamas war is a localized problem. Many airlines chose to stop running flights to Israel and use their planes for other routes instead.

During the fourth quarter of 2023, 180,000 tourists visited Israel, an 82% decrease from the 930,000 tourists recorded in the same period in 2022.

“Looking back to 2023, it was supposed to be a record-breaking year for tourism in Israel,” Peleg Lewi, foreign affairs adviser to the Tourism Ministry, told The Media Line. “We averaged between 15,000 to 20,000 tourists daily, but on October 8, we only had 26 tourists. The industry was completely devastated.”

The number of tourists in Israel has slowly increased since the war broke out. “We’re now at around 25% to 30% of last year’s levels, with about 4,000 to 5,000 tourists entering daily,” Lewi said. “The tourists we’re seeing now are different from previous years. Most are faith-based visitors, such as Jews from the Diaspora, Catholics, evangelicals, and other Christian denominations. Many are coming in some form of volunteering or solidarity projects.”

After many airlines canceled flights to and from Israel, the Israel Airports Authority closed Terminal 1, the terminal used for low-cost flights. Last week, the terminal reopened for low-cost international flights.

The Israel Airports Authority reported that the terminal will handle approximately 1,200 flights per month, carrying 200,000 passengers, with daily peaks of 6,500-7,000 passengers in July and August, a period during which many Israelis travel abroad for vacations.

“It’s understandable that people still feel it isn’t safe to travel to Israel at this point, but this initiative to reopen Terminal 1, with many low-cost airlines, will also benefit Israelis, which psychologically will be very important to many people,” Lewi said. “Airline tickets have been very expensive since October 7, and hopefully some people will be able to enjoy this morale boost in times of war. Nevertheless, airline tickets and travel insurance remain more expensive than normal times.”

Ryanair, an Irish low-cost airline, is the first low-cost carrier to resume operations in Israel. Lewi hopes that that decision will be a tipping point. “Eventually, other airlines will see things are somewhat normal despite the war and return their operations as well,” he said.

Israel’s successful response to the Iranian attack in April sent a message to the airline industry, Lewi said. “The successful interception of 99% of Iran’s attack achieved something they never considered. It proved that it was safe to fly to Israel,” he said. “Ben Gurion Airport wasn’t even at risk, and there was no damage.”

Flights to Israel are profitable for airlines, Lewi said, so the companies were eager to restart flights to Israel when it was safe to do so.

The aviation industry has faced unprecedented challenges over the past few years. Aviation insurance expert Vikrant Sharma told The Media Line that war insurance rates for airlines have increased fivefold since the start of the war in Ukraine. Some major reinsurers—companies that provide insurance to insurance companies—are no longer dealing in hull war insurance, which covers damage to an airplane in war.

“Stricter sanctions worsen the situation, making it difficult to procure fuel, pay airport charges, spare parts support, or receive compensation for losses,” Sharma said. “The global aviation sector has felt the ripple effects, with higher hull war premiums becoming the norm.”

The Israeli government has tried to implement policies to reverse the damage. “The government is offering self-insurance options or guarantees to cover potential losses,” Sharma said. “This approach, already employed by various sanctioned countries, provided a viable alternative for airlines to continue operations despite the heightened risks. All of this was also possible [because] the political backing from allied nations facilitated continued operations, providing airlines with the necessary assurances to navigate the complex insurance landscape.”

Even after Israel’s successful interception of the Iranian missile attack, fears of escalation still make the aviation insurance industry wary.

“This tension can affect risk perceptions, particularly in aviation, where airspace safety is crucial,” Sharma said. “The Israeli government could take proactive measures to mitigate these concerns and restore confidence in aviation. Providing explicit security guarantees and collaborating with top reinsurers to conduct thorough risk assessments can help reassure airlines and passengers. By involving reputable reinsurers who can evaluate the situation impartially and scientifically, Israel can build a stronger case for the safety of its airspace. This, in turn, could encourage insurers to reconsider their positions and resume providing coverage, thereby normalizing aviation activities in the region.”

Local tourism businesses will likely continue to struggle in the coming months even as more airlines return to Israel. Asaf Ben Ari, CEO of Bein Harim, Israel’s largest tour operator, said of the reopening of Terminal 1: “The news is great, but unfortunately, it’s not really changing the incoming tourism industry. Not yet at least.”

“The Israeli people who go on vacation can find cheaper flights and more destinations with this news, but we still see approximately the same number of tourists in Israel,” he explained. “Many visitors coming to Israel are foreign workers or Jews from the Diaspora coming to Israel to visit their families. It’s great they can come to Israel, but they aren’t tourists, and they don’t have the same impact on the economy.”

He noted that many tourists are interested in seeing Israel’s border communities, including those on the border with Lebanon and Syria. “We’re not offering these tours because there still is a lot of uncertainty, and we can’t take these risks,” Ben Ari said. “In fact, for regular travelers, the risks are still too much, and we understand them. The whole industry still sees these risks. Many travel insurance companies increased their prices or stopped providing insurance to travelers coming to Israel.”

Ben Ari called on the Israeli government to do more to support the tourism industry, which is no longer receiving government support as of the new year. “If we don’t start to see changes, and so far, the government isn’t doing much in that sense, the industry will keep bleeding, and workers will suffer,” he said.

The story is written by Nathan Klabin and reprinted with permission from The Media Line